Draft CDC Guidelines Say Benefits Of Male Circumcision Outweigh Risks

The question "To cut or not to cut the penis's foreskin" would get another round of debate anew in the medical community as the U.S. Centers for Disease Control and Prevention (CDC) issued on Tuesday draft guidelines on circumcision.

China Drops To 100th Spot In Corruption Index Despite President Xi’s Anti-Corruption Campaign

China's drop by 20 places in the Corruption Index released by Transparency International on Tuesday seems to say that the anti-corruption campaign by Chinese President Xi Jinping is not effective in wiping out graft.

Australian Stock Market Report – Morning December 4, 2014

In US economic data, the ISM services index rose from 57.1 to 59.3 in November, above forecasts for a result near 57.5. The ADP survey showed that 208,000 jobs were created in November, just short of expectations for 221,000 job growth. The mortgage market index fell by 7.3% in the latest week, dragged down by a fall in refinancing.

Australian Stock Market Report –Afternoon December 3, 2014

Australian shares maintained most of their gains with the ASX 200 Index rising by 0.8 per cent; trading above 5300pts and adding to yesterday's 1.4 per cent surge. Energy and mining sectors improved by between 0.7 per cent and 1.2 per cent despite a slump in oil, gold and iron ore prices.

36-Year-Old Man Who Posted Topless Photos Of Ex-GF Is 1st Revenge Porn Convict In California

California's revenge porn law took effect on Monday, and a 36-year-old Los Angeles man was its first convict. Noe Iniguez posted topless pictures of his former girlfriend online, which resulted in his conviction.

Australian Stock Market Report – Midday December 3, 2014

Local shares saw a mixed start to trade on Wednesday after the strong gains of the previous session. The ASX 200 opened with a loss of 20 points, however those levels found buying support and over the ensuing hours the market was able to fight its way back into positive territory. At the best levels of the morning the index was up by 50 points and as lunchtime loomed every ASX sector was in positive territory.

Hoax Alert: After Being Criticised As Lacking Class, Malia Obama Hit By Fake Pregnancy News

Elizabeth Lauten's criticism of Malia and Sasha Obama and her resignation over the brouhaha caused by her Facebook post as well as stories that the critic was a shoplifter during her teens is old news. The latest headline designed to further damage the Obama image is speculations that 16-year-old Malia is allegedly pregnant.

Macau’s Tax-Free Status Means About 20% Of Pacquiao’s Prize Money From Algieri Bout Would Go To Philippine Taxman

Manny Pacquiao's foe is back. No, it's not Floyd Mayweather Jr with whom Pacquiao is exchanging jabs on Instagram. It's the Philippine taxman who is again running after the Filipino champ's earnings.

Australian Dollar Outlook – December 3, 2014

The Australian Dollar has slipped back below USD 0.8500, being driven by a strengthening US Dollar, concerns over Australia's economy and uncertainty about the Reserve Bank's next move.

Global Markets Overview – Morning December 3, 2014

2015 is gearing up to be the stress test of the Australian economy for the millennium.

Queensland’s Palm Cove 10th Placer In Flight Center’s List Of Places To See In 2015

Australian cities may be one of the top places to live or raise a family, but when it comes to being a vacation spot, only one Australia place was included in a bucket list made by Flight Center.

PM Tony Abbott Angers Gender-Neutral Group With Sexist Remarks About Toys

Former Australian Prime Minister Julia Gillard has retired from politics, so she could no longer question present Prime Minister Tony Abbott's outdated outlook towards gender.

Australian Stock Market Report – Morning December 3, 2014

In US economic data, chain store sales fell by 0.6% in the latest week but the annual growth rate of sales rose from 4.2% to 4.8%. Construction spending rose 1.1% in October, ahead of expectations for a 0.6% gain. And the ISM New York index rose from 657.2 to 663.4 in November.

RBA Retains 2.5% Overnight Cash Rate For 16th Straight Month To Boost Aussie Economy Amid Falling Commodity Prices

The economists were right again. As they predicted, the Reserve Bank of Australia (RBA) kept on Tuesday for the 16th straight month the overnight cash rate at the record low 2.5 percent.

Australian Stock Market Report – Midday December 2, 2014

Australian shares are being led higher by the mining and energy sectors with the ASX 200 Index rising by 0.7 per cent. Despite today's rise, the local market had its worst day since 10 October yesterday, hit a 1.5 month low in the process and slumped by 3.5 per over two sessions.

Resigned Elizabeth Lauten Had Other Misdemeanor As A Teen Than Just Shoplifting; White House Says Obama Girls Should Be Off-Limits To Criticism

Newly resigned GOP staffer Elizabeth Lauten's woes has just started. Aside from the challenge of finding a new job after she quit her post as communications director of Republican Rep Steven Fincher over her critical posts of the Obama daughters in Facebook, her past as a teenager is catching up on her.

Australian Dollar Outlook – December 2, 2014

The focus turns to the RBA. Rates are expected to remain unchanged, but the statement is likely to be AUD dovish.

Global Markets Overview – December 2, 2014

Tough time to be a commodities trader; overnight trade saw silver moved through a 15% range, gold moved through a 6% range, Brent crude near enough to 7% while copper moved through a 4% range. A look at the commodities boards suggested Christmas festivities had come early, as each moved from negative to positive and vice-versa.

Pacquiao Hits Back At Mayweather In Latest Instagram Post

The dream match between Manny Pacquiao and Floyd Mayweather Jr still hangs in the air since there is nothing yet concrete between the two camps save for negotiations and offers.

Susan Boyle Moves From ‘NBSB’ To ‘In A Relationship’

In her Facebook account, Britain's Got Talent 2009 runner-up Susan Boyle did not alter her status to "In a relationship," but did admit to The Sun in an interview that she has a boyfriend. The 53-year-old singing sensation met him in a hotel when she was on a US tour.

Deutsche Bahn Seeks $3B Damage From 13 Airlines For Price Fixing

Deustche Bahn, the German state-owned railway, filed a new lawsuit in Germany and the U.S. seeking over $3 billion in damage from 13 air cargo companies for price fixing. Included in the lawsuit is Australian flag carrier Qantas which has paid over $160 million for increasing the price of freight via fuel and security surcharges between 2000 and 2006.

Australian Stock Market Report – Morning December 2, 2014

In US economic data, the ISM manufacturing index eased from 59.0 to 58.7 in November, above forecasts for a result near 57.8.

Lautengate: GOP Staffer Quits Over Malia & Sasha Posts; Netizens Expose She Was Allegedly Caught Shoplifting As A Teenager

The turkeys were pardoned for Thanksgiving, but netizens were not willing to extend the same forgiveness to Elizabeth Lauten, the communications director of Republican Rep. Steve Fincher. Her criticisms of the behavior of Malia and Sasha Obama through a Facebook newsfeed became viral and created a political storm too powerful for her to handle. On Monday morning, Lauten announced through NBC News that she is quitting her post, following the strong public clamor for her to resign or for Fincher t...

Australian Stock Market Report – Midday December 1, 2014

A new month and a new week has started the same way the last month ended, with sellers in control. The ASX started the session with a 5 point loss before trading to the low point of the morning where the index chalked up a deficit of almost 47 points. Over the course of the morning there was little evidence that buyers saw value at the newly discounted levels which had taking the market to the lowest levels in around 6 weeks.

Australians Plan To Spend $8.3B On Christmas Presents; Melbourne CBD Shop To Remain Open Until 9 PM

It would be a happy yearend for Australian retailers with the ka-ching of cash registers expected to ring more often for the last month of 2014. Comparison Web site finder.com.au estimates that Aussies will spend $8.3 billion for Christmas presents shopping alone.

Australian Dollar Outlook – December 1, 2014

The Australian Dollar has opened this week's trading below the 85 cent level as commodity currencies remain under pressure.

Global Markets Overview – December 1, 2014

US investors came back to from Thanksgiving on Friday and gave oil a mauling on the back of OPEC nations' inaction on Thursday.

WBC Supports Pacquiao-Mayweather Bout; UAE Offers $110M Guaranteed Purse

The World Boxing Council (WBC), which considers Floyd Mayweather Jr as its current welterweight title holder, has joined the growing list of boxing organisations and individuals that are pushing for Mayweather to box against Filipino champ Manny Pacquiao.

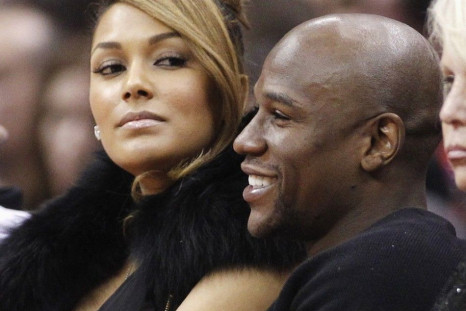

Floyd Mayweather Defends Posting Of Shantel Jackson’s Sonogram

Both being public figures is a licence for boxer Floyd Mayweather Jr to post copies of the sonogram of his former fiancé Shantel Jackson as well as share to the public that she had an abortion.

Calls For Firing Of Republican Staffer Elizabeth Lauten Grow Stronger Over Facebook Criticism Of Obama Daughters

A Republican staffer is in the eye of a political storm after she criticised the behaviour of Malia and Sasha at the traditional Turkey Pardoning Ceremony in the White House. Elizabeth Lauten, communications director of Rep. Stephen Lee, described the teen presidential daughters as disrespectful and classless.