Here’s where Australia’s construction 'hotspots' are

Australia had built more homes than ever during the 2015-16 financial year, a residential building boom most evident in a suburb between the Gold Coast and Brisbane in Southeast Queensland. Pimpama was listed as the hottest of the “hotspots” in the said financial year with $340.2 million worth of approved dwellings.

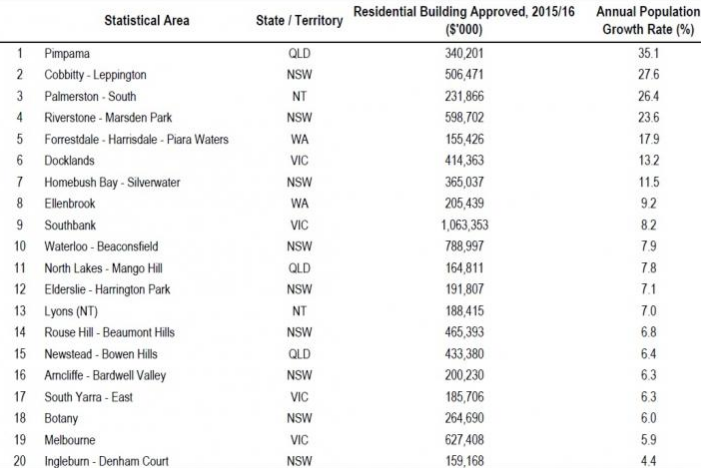

The Housing Industry Association (HIA) has released a list of Australia’s top 20 residential building hotspots for the 2015-16 financial year. The body deems a “hotspot” as a region where at least $150 million worth of residential building had been approved and where population rose above the 1.4 percent national average. In Pimpama, the population growth was recorded at 35.1 percent.

Nine of the top 20 hotspots listed by the group were in New South Wales. Four were in Victoria, and three were in Queensland. Several of those were in inner-city regions, courtesy of an unmatched level of apartment construction in these areas.

Cobbitty-Leppington in Sydney’s Southwestern edge secured the second spot. It was followed by Palmerston in Darwin. Docklands and Southbank in Melbourne and Waterloo-Beaconsfield in Sydney, which are inner-city locations, also made it to the top ten. Here is the complete list.

The fall

During the March quarter of this year, the value of construction work fell 0.7 percent to $46.4 billion, according to The Australian. The fall, a slightly sharper drop than expected, is doomed to have an impact on economic growth.

Housing construction was down 4.7 percent in the quarter and has become the biggest drag in the value of construction work. It is likely that developers are opting to lie low on residential projects due to concerns of oversupply.

UBS economist George Tharenou declared that construction fell further to the lowest level since 2011. "While the fall was largely as expected, the sharp retracement of housing was a negative surprise."

National Australia Bank's Tapas Strickland has warned that the situation could impact the March quarter economic growth. The topping out of apartment construction has become a key element of the outlook for growth and interest rates. It has also become the main source of employment growth in the economy to date.

Despite the recent fall, the HIA forecasted that residential construction will stay at elevated levels. The group said in March that the annual volume of new home starts is not likely to drop below 173,000, although new dwelling starts will decline over the next couple of years.

Read More:

Aussie dollar doomed to fall amid declining Australia-US bond spread

Don't commit these tax errors in June to avoid financial burden

The Weekly/YouTube