WiseTech Global Offices Raided by Police, Regulators Over Chairman Richard White's Share Trading

Australian logistics software giant WiseTech Global faced a dramatic turn of events on Monday as federal police and financial regulators descended on its Sydney headquarters to investigate alleged improper share trading by its chairman and founder, Richard White.

Major Raid Shakes Australia's Tech Sector

The Australian Federal Police (AFP) and the Australian Securities and Investments Commission (ASIC) executed a search warrant at WiseTech Global's offices as part of an ongoing investigation into alleged share trading activities by White and three other company employees.

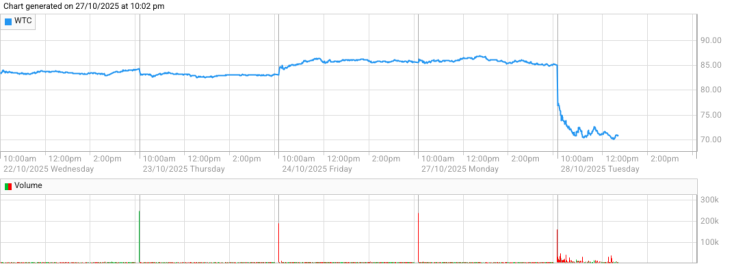

The unprecedented action sent shockwaves through the Australian business community, with WiseTech shares plummeting nearly 17% to A$70.60 – their lowest level in more than six months. The company's market value took a significant hit as investors reacted to news of the regulatory probe.

What Are Authorities Investigating?

According to the search warrant, authorities are seeking documents related to alleged trading in WiseTech shares during a specific period spanning from late 2024 to early 2025. The investigation focuses on whether proper procedures were followed during these transactions.

Reports earlier this year revealed that White sold more than $200 million worth of WiseTech shares without following the company's proper processes. The allegations include trading during formal blackout periods – windows when senior executives are explicitly prohibited from selling company stock.

No Charges Filed Yet

It's important to note that no charges have been laid against any individual at this stage, and there are no allegations against WiseTech Global as a corporate entity. The company has stated it "intends to fully cooperate with any investigation."

ASIC's involvement signals the seriousness of the probe, as the regulatory body has extensive powers to investigate potential breaches of corporate and securities law.

A Troubled Year for WiseTech Leadership

This latest development adds to what has been a tumultuous period for WiseTech Global's leadership. In February, ASIC launched preliminary inquiries into the company following a mass exodus of senior executives and the unexpected return of Richard White as chairman.

White had previously stepped down as CEO in October 2024 after media reports surfaced containing allegations about his personal life, including claims of payments to a past sexual partner. His return to the chairman role months later raised eyebrows in corporate circles.

WiseTech's Market Position at Risk

WiseTech Global has long been considered one of Australia's most successful technology companies, specializing in logistics software solutions used by freight forwarders and customs agents worldwide. The company's flagship product, CargoWise, serves thousands of logistics companies across more than 160 countries.

The ongoing investigation threatens to undermine investor confidence in the company at a critical time for Australia's technology sector. Corporate governance experts have warned that regulatory actions of this magnitude often lead to prolonged uncertainty, regardless of the eventual outcomes.

What Happens Next?

As the investigation continues, market analysts will be closely watching several key developments:

- Whether ASIC and AFP gather sufficient evidence to press charges

- How WiseTech's board responds to the allegations

- The potential impact on the company's operations and client relationships

- Whether additional executives become implicated in the probe

The investigation could take months or even years to reach a conclusion, leaving WiseTech and its shareholders in a state of uncertainty.

Industry Implications

This case has broader implications for corporate governance standards across Australian listed companies. It serves as a reminder that even highly successful executives are subject to strict trading rules designed to protect market integrity and prevent insider trading.

The involvement of both federal police and ASIC suggests authorities are taking a comprehensive approach to investigating potential violations of both criminal and civil securities laws.

As WiseTech Global navigates this challenging period, the spotlight remains firmly on corporate accountability and the enforcement of trading regulations in Australia's financial markets. The outcome of this investigation could set important precedents for how similar cases are handled in the future.

© Copyright 2025 IBTimes AU. All rights reserved.