Canada’s top CEOs drawing fat salaries despite a weak economy, says study

Canada’s economy may be hit hard by falling oil prices, but the leaders of its top companies are still drawing fat salaries. This paradox was the highlight of a recent study that covered Canada’s 100 highest-paid CEOs.

The report said Canada’s best paid chief executive officers take-home pay was an average CA$8.96 million (AU$8.96 million) in 2014. The report prepared by the Canadian Centre for Policy Alternatives claimed that the CEO salaries are 184 times more than the average pay of a Canadian worker, who earned CA$48,636 (AU$48, 636) in 2014.

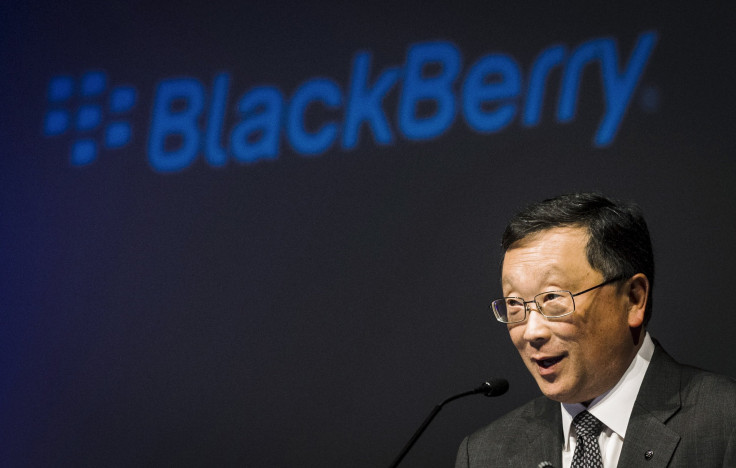

Blackberry CEO at the top

The topper in the list was Blackberry’s John Chen whose total compensation was a whopping CA$89.7 million (AU$89.7). The main runner-up was Donald Walker, CEO of Magna International Inc with his CA$23.4 million as compensation, reported Toronto Star.

Analysing the results, research associate Hugh Mackenzie said the mismatch between the weakening economy and big CEO compensation is too hard to ignore.

“What really struck me more than anything else — given the fact that the Canadian economy was already quite weak and commodity prices were already deteriorating in 2014 — was the resilience of CEO compensation,” he said.

Mackenzie studied proxy circulars of the 249 publicly-listed Canadian corporations on the Toronto Stock Exchange to prepare the report. It noted that many CEOs made much more than the CA$9 million average with boosts from bonuses, stock options, pensions forming the lion’s share of the executive pay.

Though the average CEO pay in 2014 was actually down two percent from 2013, the trend has been spirlling payment packages. Compensation was up 22 percent in 2014 since the survey started in 2008, while salary for the average Canadian rose only 11 percent in the same period.

The study also highlighted the dominance of share grants over stock options as the way to reward company bosses. This is because stock options fell from 21 percent of pay in 2008 to 13 percent in 2014 while share grants jumped from 26 percent to 39 percent, between 2008 and 2014.

“So from an after-tax perspective, a dollar received from the exercise of a stock option is worth two dollars of salary income,” the author said.

Different perspective

However, in a different take, Montreal Economic Institute pointed out that the total annual pay of the top 100 CEOs is not that big, when compared to the size of the overall economy and size of the federal government, reports Canadian Business.

Highly paid top 10 CEOs

- John Chen-Blackberry Ltd

- Donald Walker-Magna International Inc

- Gerald Schwartz-Onex Corporation

- Hunter Harrison-Canadian Pacific Railway Ltd

- Mark Thierer-Catamaran Corp

- Donald Guloien-Manulife Financial Corp

- John Thornton-Barrick Gold Corp

- Paul Wright-Eldorado Gold Corp

- Bradley Shaw-Shaw Communications Inc

- Steven Williams-Suncor Energy Inc