Global Markets Overview – September 19, 2014

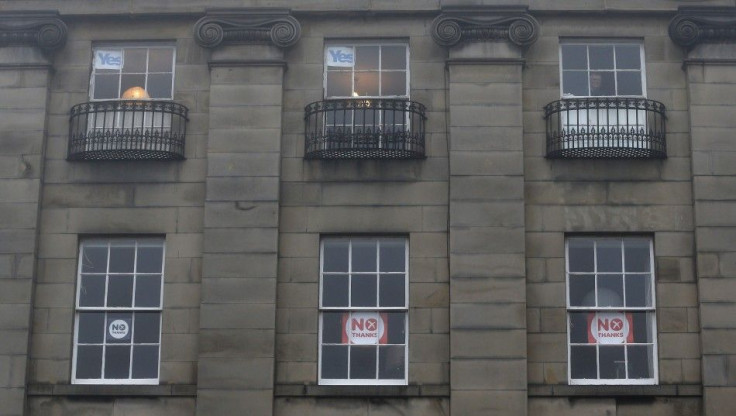

Scotland Decides

The biggest market volatility events of 2014 are almost over. The FOMC was yesterday, Scotland voting for independence is today and Alibaba, with its mass market interest, is tonight.

This morning we have seen the conformation of the IPO price at 68 dollars - the top of the range. This means Alibaba is looking to raise $21.8 billion, making it the largest IPO in US history. One to watch on the open tonight for Asia.

Scotland Decides:

The movements in cable have been a very interesting affair. On the open of the polls at 7am GMT (4pm AEST), GBP/USD jumped 50 pips and methodically moved up to $1.64 - a level which held for the rest of voting.

On the close of the polls, cable was unmoved at $1.641. However, the final YouGov predictor at 10.30pm GMT (7.30am AEST) showed an expected 54% 'No' to 46% 'Yes' and cable rallied to $1.645 - that's 1.2 cents in 24 hours. The polls, coupled with the moves in cable, all suggest the NO campaign has won convincingly.

What will be interesting is the fallout from the vote. Will there be a deep divide in the country or will it mend quickly? Will Scotland's independence supporters look to start another campaign in a few years? Or will this spell the end of the independence movement for the next decade or so?

I would revert to history to answer these questions - the 1995 Quebec vote gives us the prime example.

In the lead up to the polls, the YES campaign was actually ahead all the way before being pipped by the narrowest of margins on the final day. Following the vote, the desire for independence actually fell away and Quebec has not gone back to the polls since the 1995 referendum.

That does not necessarily mean Scotland will take the same path, but the similarities suggest the likelihood of a vote in the next five years will diminish on a strong NO vote.

We will be watching the FTSE futures and cable all through the day, and particularly at 5pm on the open of the market in London, to see how the country has taken the news.

Ahead of the Australian open

We're currently calling the ASX 200 up 19 points to 5434. Tradeyesterday was sporadic and very unconvincing. However, it managed to maintain the trend of bouncing on the RSI after crossing the 30 line. Since June 2010 the market has bounced every time the RSI has been crossed - a bounce which tends to hold for the week after the fact.

The banks remain the area to watch on this recovery, considering they too have been oversold. We see any recovery as just that - a recovery. On a short-term view, we see more selling in the yield trade as international investors get squeezed by the falling currency and eroding total returns.

Asian markets opening call | Price at 8:00am AEDT | Change from the Offical market close | Percentage Change |

Australia 200 cash (ASX 200) | 5,434.70 | 19 | 0.35% |

Japan 225 (Nikkei) | 16,217.60 | 151 | 0.94% |

Hong Kong HS 50 cash (Hang Seng) | 24,253.40 | 85 | 0.35% |

China H-shares cash | 10,837.90 | 38 | 0.36% |

Singapore Blue Chip cash (MSCI Singapore) | 372.09 | 1 | 0.25% |

US and Europe Market Calls | Price at 8:00am AEDT | Change Since Australian Market Close | Percentage Change |

WALL STREET (cash) (Dow) | 17,280.60 | 116 | 0.67% |

US 500 (cash) (S&P) | 2,013.18 | 11 | 0.55% |

UK FTSE (cash) | 6,834.10 | 37 | 0.54% |

German DAX (cash) | 9,810.60 | 118 | 1.21% |

Futures Markets | Price at 8:00am AEDT | Change Since Australian Market Close | Percentage Change |

Dow Jones Futures (September) | 17,279.00 | 116.50 | 0.68% |

S&P Futures (September) | 2,013.25 | 11.00 | 0.55% |

ASX SPI Futures (September) | 5,421.00 | 0.00 | 0.00% |

NKY 225 Futures (December) | 16,177.50 | 157.50 | 0.98% |

Key inputs for the upcoming Australian trading session (Change are from 16:00 AEDT) | Price at 8:00am AEDT | Change Since Australian Market Close | Percentage Change |

AUD/USD | $0.8989 | 0.0021 | 0.23% |

USD/JPY | ¥108.730 | 0.000 | 0.00% |

Rio Tinto Plc (London) | £32.28 | -0.12 | -0.35% |

BHP Billiton Plc (London) | £18.38 | 0.21 | 1.16% |

BHP Billiton Ltd. ADR (US) (AUD) | $35.70 | 0.02 | 0.05% |

Gold (spot) | $1,225.65 | 1.25 | 0.10% |

Brent Crude (October) | $97.61 | -0.80 | -0.81% |

Aluminium (London) | 1984 | -14.00 | -0.70% |

Copper (London) | 6834.25 | -94.25 | -1.36% |

Nickel (London) | 17858 | -203.00 | -1.12% |

Zinc (London) | 2256.75 | -6.00 | -0.27% |

Iron Ore (62%Fe) | 83 | -1.20 | -1.43% |

[Kick off your trading day with our newsletter]

More from IBT Markets:

Follow us on Facebook

Follow us on Twitter

Subscribe to get this delivered to your inbox daily