Global Markets Overview – November 3, 2014

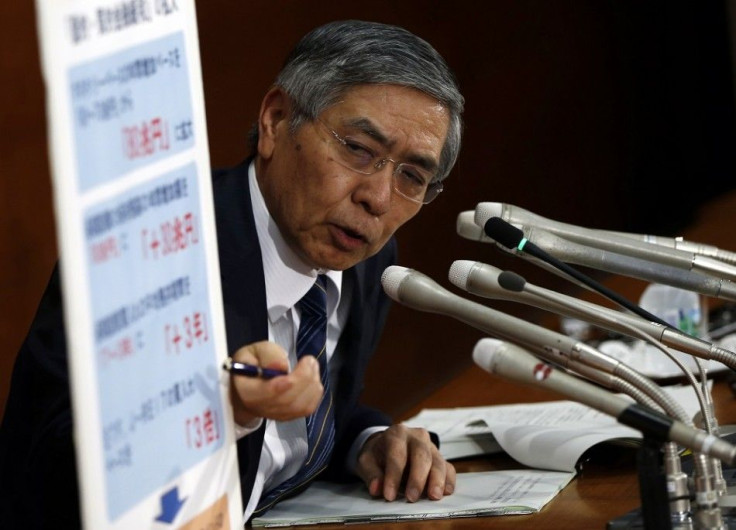

The BoJ took everyone by surprise on Friday. The shock of a ¥30 trillion increase in the pace of long-term government bonds (JBG's) and major portfolio rebalancing from the Government Pension Investment Fund (GPIF) has added a new dimension to the global currency wars.

Traders centred the bulk of their buying on the Nikkei. However, given the violent move lower in the JPY, traders also had to hedge out the currency exposure on the position by being long AUD/JPY (if they were Australian clients). Certainly, the vote on further easing was tight. However, history has taught us the BoJ have a history of surprising and they know how to play the market very well, with most expecting this action to materialise in January. The fact they announced such aggressive action on a Friday afternoon saw traders spring into action, but then of course they had the added benefit of knowing European, UK and US traders could give the USD/JPY and Nikkei futures an extra leg higher - which has clearly been the case.

Japan looking very attractive again

The fact the GPIF will increase its portfolio allocation to hold a 25% weighting of domestic equities has been speculated on in the media of late, so it's not a complete shock. And, of course, the massive amount of funds that will be used to buy domestic equities will not go into the market at once - it will be a slow process. It does, however, highlight that the Nikkei and Topix are attractive markets and it seems authorities are effectively going down the same road as the Federal Reserve in trying to target a higher stock market. In turn, they're trying to increase the domestic wealth effect and ultimately boost monetary velocity.

USD/JPY longs are still attractive, especially given most of the buying of foreign assets will be unhedged, but I would be looking much more closely at EUR/USD shorts given the prospect government officials now try and limit the JPY's weakness. This has already come to fruition, with Japan's ruling LDP secretary-general Sadakazu Tanigaki saying sudden FX movements and too much JPY weakness could cause problems.

Asian markets obviously flew on Friday and it will be interesting to watch upcoming flow data from the Japanese Ministry of Finance this week. We need to monitor Japanese investor behaviour as it seems logical that Australian and US bonds will be further sought. AUD/JPY looks like a buy in this case, as will any equities that have bond-like (or high yield) characteristics - such as Telstra and the banks. With volatility settling down and risk sentiment high, carry trades in the forex market and income strategies in both equities and high yield should perform well. All the bulls need now is a strong hint from the ECB this Thursday that they could buy government bonds in 2015 and equity markets will continue to push higher into the New Year.

Global easing helping push the S&P to new all-time closing highs

The bulls will be happy with a new all-time closing high in the S&P, with really strong performances from small caps and semiconductors (the barometer of the feel-good factor). With S&P 500 futures following the Nikkei's move, some of the 1.2% move in the S&P 500 cash session is already priced into the Asian open. However, S&P futures are still up 0.4% from the Australian equity close and this therefore suggests follow-through buying on the open.

One key development in the US session was the 70 basis point increase in the quarterly Employee Cost Index (ECI), some 20 basis points (or 0.2 percentage points) better than forecast. This is a wage component the Fed look at closely, but on an annualised basis it's hardly thematic of a central raising of the funds rate in Q1. Still, the USD is the star performer and I'm looking for EUR/USD to break the October 3 lows of $1.2501 this week, although the market will be focusing on the mid-term elections, ISM manufacturing and the payrolls report, as well as the ECB meeting on Thursday. Gold has been hit hard on the recent USD strength, but it's been driven by USD/JPY more closely than EUR/USD. Watch gold plays in Australia today as gold miners in the US were sold off fairly hard.

Japan is closed today for Culture Day, although futures are open. If the cash market was to open, we would like see an open above 17,000.

China's October manufacturing PMI (released on Saturday) saw the pace of expansion decline, with the index hitting 50.8 from 51.1. The market was expecting to print 51.2 so this is a reasonable miss, with the forward-looking new orders slowing to 51.6 from 52.5. This should keep the materials names from really powering on.

On a stock level, the trade remains to be in yield over global cyclicals despite a growing valuation discrepancy. Buying strength and riding the momentum still looks like a good strategy for short-term traders, with names like CSL, Sirtex, Echo, Tabcorp, Qantas, Tatts and Invocare looking really strong on the daily charts, albeit showing overbought readings on the oscillators.

Westpac result

Westpac have also released a strong full-year earnings report this morning, which should support the market as well. Cash earnings grew 8% and are very modestly above expectations, while we saw a sizeable improvement in return on equity (+48bp), with its net interest margins beating The Street's forecast. Gail Kelly was upbeat on the company's prospects. The one disappointment may be the slightly below-par final dividend, but all-in-all the asset quality is improving and you can see why WBC are the best performing bank in the ASX 200.

Market | Price at 8:00am AEDT | Change Since Australian Market Close | Percentage Change | Change on Official Closing price | Percentage Change |

AUD/USD | 0.8744 | -0.0050 | -0.58% | -0.0050 | -0.58% |

USD/JPY | 112.8300 | 2.2400 | 2.03% | 2.2400 | 2.03% |

ASX (cash) | 5539 | 13 | 0.23% | 13 | 0.23% |

Hong Kong HS 50 (cash) | 24004 | -6 | -0.03% | 6 | 0.03% |

China H-shares (cash) | 10765.3 | -25 | -0.23% | 10 | 0.09% |

Singapore Blue Chip (cash) | 370 | 4 | 0.99% | 2 | 0.55% |

US DOW (cash) | 17366 | 47 | 0.27% | -25 | -0.14% |

US S&P (cash) | 2015 | 7 | 0.35% | 44 | 2.24% |

UK FTSE (cash) | 6543 | 26 | 0.39% | 1 | 0.01% |

German DAX (cash) | 9325 | 121 | 1.31% | 476 | 5.38% |

Japan 225 (cash) | 16998 | 647 | 4.33% | 2061 | 13.79% |

Rio Tinto Plc (London) | 29.80 | 0 | 1.12% | 0.33 | 1.12% |

BHP Billiton Plc (London) | 16.25 | 0.09 | 0.57% | 0.09 | 0.59% |

Gold (spot) | 1174.16 | -20.09 | -1.68% | -20.1 | -1.68% |

Iron Ore | 78.5 | -0.50 | -0.59% | -1 | -0.63% |

Dow Jones Futures (December) | 17303 | 57 | 0.33% | 57 | 0.33% |

S&P Futures (December) | 2009 | 7 | 0.35% | 7 | 0.35% |

ASX SPI Futures (December) | 5522 | 5 | 0.09% | 5526 | 100.15% |

NKY 225 Futures (December) | 17048 | 658 | 4.01% | 658 | 4.01% |

[Kick off your trading day with our newsletter]

More from IBT Markets:

Follow us on Facebook

Follow us on Twitter

Subscribe to get this delivered to your inbox daily