Australia’s CommChain Launches Blockchain-based Bulk Commodity Trading Platform

Whether hard metals such as Nickel, Copper and Zinc, or raw materials such as Coal, Iron Ore and Potash, the global commodity trading space is a multi-trillion dollar arena. This extremely diversified trading arena subsequently covers a wide-range of vested parties - from producers, buyers, traders, financial institutions, government authorities and a plethora of other stakeholders involved in the end-to-end supply chain.

However, the underlying framework that facilitates the cross-border trading of commodities is still highly inefficient, cumbersome and somewhat outdated.

The reason for this mainly centres on the fact that the vast majority of the commodity trading industry still relies on a manual, paper-based system.

Not only this, but these issues are further amplified by inefficient trade financing and issues pertaining to compliance and regulation.

Ultimately, it is highly feasible that the potentialities of blockchain technology could alleviate these issues with the presence of a modern, secure, transparent and fully digitized commodity trading sphere.

Digitizing the Commodity Trading Industry

Brisbane-based CommChain is one recently founded company looking to combine the power of blockchain technology and bulk commodity trading.

The CommChain team is led by individuals with long-standing experienced in both the global commodity trading industry, as well as the emerging blockchain technology sphere.

Led by co-founder Gary Zamel, whose 30+ years' experience in commodity trading includes directorships at MST Global and Jellinbah Resources, Phil McCarthy, CEO and co-founder, a former Powercoal CEO, and Faith Dempsey, founder of TransCoal and TransBulk Logistics.

“We witnessed the costly disadvantages of the existing, cumbersome, paper-based system for commodity trading. Upon seeing the proven success of blockchain technology in other industries, and discussing this potential of this technology with stakeholders in the commodity trading industry, it was immediately clear that this business was inevitable and an ideal use case for blockchain technology,” said Zamel.

The company’s current business partners include Japanese conglomerates and trading houses Marubeni and Sojitz Corporation. R3, which specializes in enterprise blockchain solutions, has joined as Commchain’s technology partner for supporting its platform.

A Dire Need to Reduce Cumbersome Paper-Based Systems

CommChain is looking to revolutionize the bulk commodity trading by eliminating the need for paper-based documentation.

At present, the vast majority of documents such as bill of landings, invoices and custom authorization letters are either distributed via physical courier deliveries, or in some cases, by email and fax. This outdated documentation transfer is not only slow and inefficient, but also costly. Through the use of a blockchain technology, CommChain aims to streamline the process in the form of digitization.

As such, this has the potential to fast-track the trading process to eliminate courier costs and substantially reduce the fees associated with port agents.

A Necessary Change in Settlements

On top of mundane paper-based processing, the risks of fraud, non-compliance and other regulatory threats has led to a bulk commodity trading industry that often leaves sellers based in emerging markets with liquidity and financing constraints.

By facilitating payments via the CommChain network, settlement times can be completed in less than 3 days. This ultimately creates a more efficient trading area when it comes to exchanging currency for goods.

When asked about the future of blockchain-based bulk commodity trading, Zamel noted that “We aim to change the way trades are conducted, monitored and optimized. Using blockchain, we can allow monitoring, tracking and trading functions to industry stakeholders throughout an end-to-end supply chain, while keeping information secure and immutable - to maintain trust among the parties involved.”

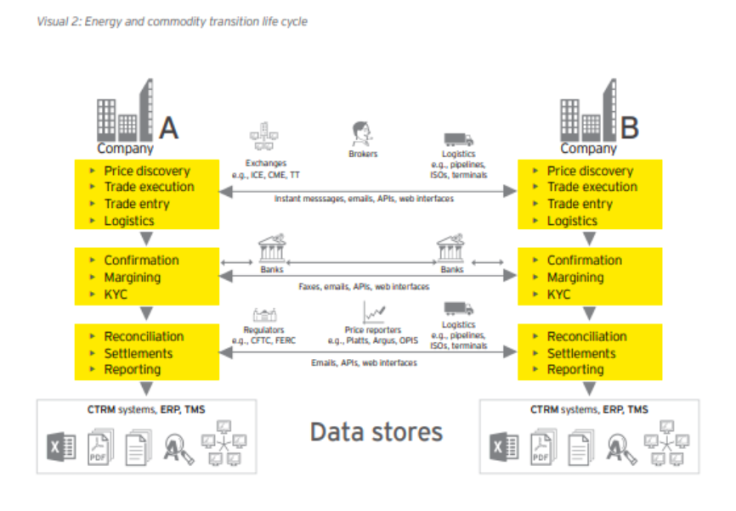

These viewpoints were mirrored in a recent report by global advisory firm EY, who noted that the commodity transaction life cycle requires a substantial number of process across multiple market participants - even for basic transactions.

EY continued by adding that through the use of blockchain technology, the commodity trading arena could yield multiple benefits such as reduced capital costs, faster settlements, a reduction in manual process and ultimately, a significant decrease on the reliance of multiple systems.

As to be expected, CommChain is not the only company in the extractives trading arena that is looking to utilize the potential of blockchain technology.

A similarly named Singaporean firm, ContainerChain, was recently acquired for AU$92m - at 6.6X revenue - by ASX-listed WiseTech Global. Despite not yet reaching profitability, this all-cash deal further demonstrates how software firms in the shipping industry are considered a hot space with untapped potential for tech driven value enhancements.

While CommChain is focused on bulk commodities, Swiss venture Komgo is aiming to reduce an ever-growing reliance on paper-based systems currently seen in the North Sea Oil & Gas sector. The company will utilize digital letters of credit via the blockchain protocol.

Then we have the likes of Everledger that are looking to apply blockchain-based ledger approaches to give moveable diamonds and precious metal assets an authenticated identity, something which would also benefit the precious extractives industry.

The underlying capabilities of the blockchain technology are likely to play a major role in the commodity trading space. Whether it's for facilitating the transition from paper-based systems to digital solutions, or improving the end-to-end financing cycle, blockchain appears to answer many of the woes facing the industry.