First Bitcoin ATM in Australia Launches in Sydney

Australia has launched its first Bitcoin ATM in Sydney despite troubles and a threat from the National Australia Bank (NAB) that it will close the accounts of businesses trading in crypto-currencies, including Bitcoin.

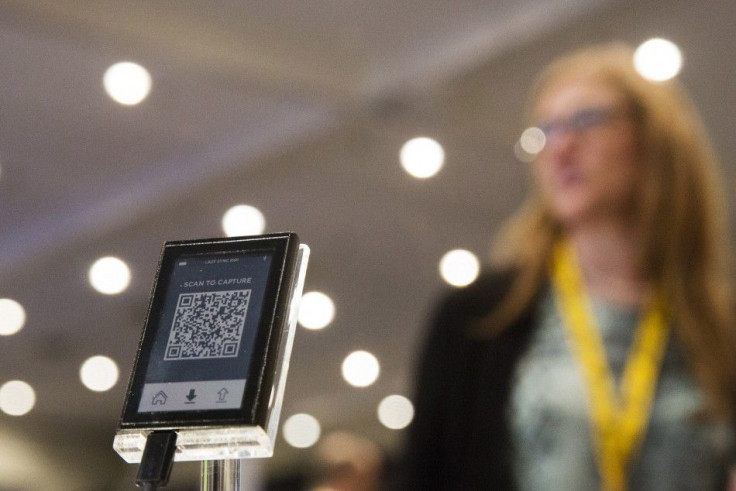

Resembling a regular banking ATM, Australian Bitcoin ATMs, also known as ABA Technology Pty Ltd, unveiled the machine inside Westfield on Pitt St in Sydney's CBD on Tuesday morning.

Chris Gruzowski, chief executive of ABA, said the machine will enable "regular people" easier and faster transactions with Bitcoin.

"Here we have it in a Westfield shopping centre where it's available immediately and securely for everyone," Mr Gruzowski said. "We want to allow every Australian to easily buy and sell bitcoin."

The ATM will enable customers withdraw cash from their existing Bitcoin wallets as well as turn their real wallets into a virtual one, ABA said.

"Bitcoin ATMs remove the indimidating [sic] and difficult aspects of buying and selling bitcoins," the company said on its Web site.

"With an intuitive, straight-forward interface and the convenience of immediate liquidity, Bitcoin ATMs attract both first time users with almost no knowledge of the cryptocurrency and its seasoned traders."

Mr Guzowski said they have placed a stringent verification process before bitcoins can be traded. For one, first-time users are required to provide appropriate identification. Once verified, consumers need to provide their phone number, PIN and the palm of their hand to authenticate transactions.

ABA plans to install some 100 bitcoin ATMs by 2015 and over 500 ATMs around the world by the end of 2016.

Bitcoin rose to more than $1100 in 2013 but plummeted to below $400 last week due to tightened controls and regulation by global central banks.

"There are more companies accepting Bitcoin, the more people accept it, the more people use it, there are tens of thousands of users in Australia and thousands new people entering the Bitcoin economy on a daily basis," Mr Guzowski said.