How Sustainable is the Online Lender Market in Australia?

Alternative Online Lending is Growing at an Unprecedented Clip Down Under

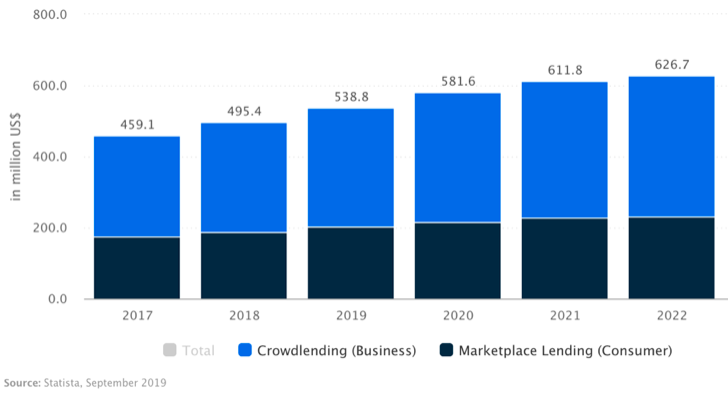

In 2019, an estimated 19.6 thousand loans have been issued in Australia through alternative lending sources. This represents 5.1% year-on-year growth, according to leading statistics portal Statista. The total value of transactions in this alternative lending sector topped out at $538.8 million in 2019, with 4.1% CAGR expected through 2023, resulting in an estimated $632.4 million by 2023.

Crowdlending practices comprise the largest component of the alternative lending sector, amounting to $336.8 million in the current year. While business crowdlending numbers certainly warrant attention, it's the robust growth in marketplace lending for consumers that is most impressive.

Alternative lending has come into its own in recent years in Australia, given the hardship suffered by individuals and businesses when attempting to obtain financing through traditional avenues. Banks make it increasingly difficult for SMEs to qualify for loans, with copious amounts of paperwork required as part of their mandatory approval process. More consumers and businesses are turning their attention to easier ways of obtaining financing for personal and business use.

FinTech companies are spearheading this initiative, with a variety of innovative solutions aimed at fast-tracking the loan applications and approval process online. While traditional banking institutions, credit bureaus, and other bricks and mortar operators focus on extensive credit checks, business performance data, and collateral, unsecured financing lenders are thriving.

Explosive Growth of Alternative Lending in Australia

Asia Money reported in December 2018 that the number of FinTech companies in Australia has increased from 100 in 2014 to 700+ at the time of writing. While the industry is subject to widespread consolidation (companies taking over other companies to become larger entities), there are still many new FinTech operations opening up across the land down under. Many FinTech enterprises cater expressly to the ‘ineligible’ SMEs that simply don't meet the expectations of traditional banks and loan companies.

As the world's most active FinTech lending nation, Australia operates on the cutting edge of this industry. Back in 2017, online lenders across Australia managed to raise $1.14 billion, over $700 million more than in 2016. It is surprising that most of these companies operate on an unsecured loans model. In other words, the loans are based upon the lender's ability to collect not the borrower's ability to repay.

Such are the advancements in online lending technology, that it is often possible to apply for loans and be approved within minutes. This reduces the approval process by weeks, possibly even months, compared to what it would take SMEs to apply and be approved for loans at a traditional bank. Given that this method of financing often means the difference between a business launching, or possibly even closing down it is a viable and thriving option in Australia.

Most of these unsecured loans have a timeframe of less than a year. Many FinTech companies are now positioning themselves as serious competition to the established banking sector. FinTech companies typically benefit from the fact that they provide easy financing to SMEs, and they generate repeat business in the process.

Leading FinTech Companies in Australia

However, the glut of unsecured financing in the Australian loans market is also raising a few eyebrows. Banks have learned a lesson or two from the Global Financial Crisis of 2008/2009, and they have established a rigid and robust framework to guard against a repeat of borrowers’ inability to repay loans. This has invariably resulted in banks rejecting many more loan applications, with estimates pointing to 1:3 being approved, and 2:3 rejected.

The Australian Securities & Investments Commission (ASIC) provides guidance on why so many people get rejected loans by Australian lenders. Among the many reasons cited include defaults on credit reports, missed payments/repayments on credit reports, income/debt ratios indicate borrowers may struggle to make their loan repayment, and not enough money saved in borrowers’ bank accounts to help make the repayments. Of course, Australian banks and traditional loan companies consider a multitude of other factors when determining who gets approved and who doesn't.

One of the leading providers of alternative financing in Australia is Prospa. This was the first Internet company to reach critical mass, with an estimated AU$500 million in loans issued, and it was also the first FinTech company to generate AU$100 million in revenues. This company, a juggernaut in the alternative lending market, was started by founders with no banking background experience whatsoever.

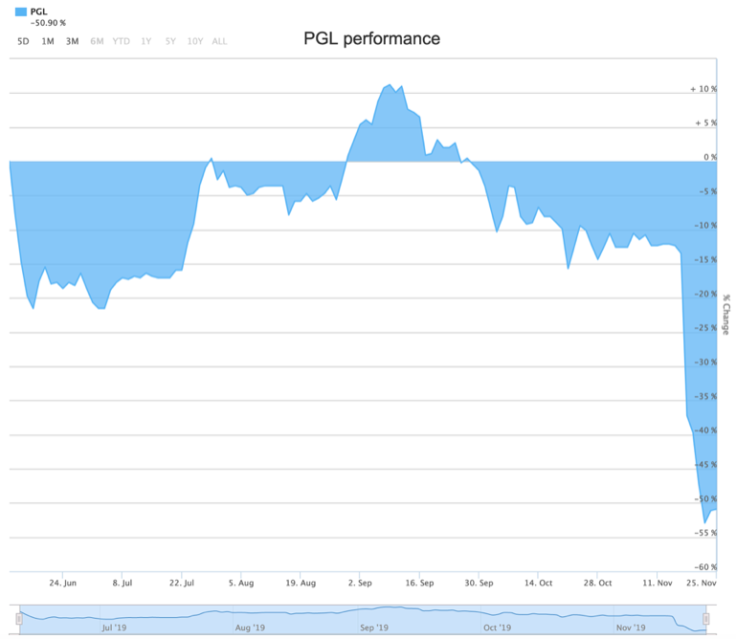

The company operates in much the same way as Silicon Valley high-tech enterprises on the other side of the Atlantic. While Prospa attempted to list on the ASX, the ASIC pushed for disclosure on how the company issues Small and Medium Enterprise loan contracts. All the rigmarole played out over the course of early 2019, resulting the company listing as PGL with a market cap of AU$353.36 million (25 November 2019).

There is a real sense of concern developing, with whisperings in the shadows about what would happen if these unsecured loans cannot be repaid. Given the sheer size of Australian mortgage debt (reached an all-time high in 2019), it is safe to say that the unsecured loans market pales in comparison to the share of the market controlled by traditional banks and financial institutions. While the landscape is certainly changing at a steady clip, much more borrowing needs to take place before the industry has the type of clout to tilt the balance of economic stability in the event of a downturn.

ASIC Steps in to Provide Framework for Listings

Moreover, the Australian Securities & Investments Commission (ASIC) is imposing rules and regulations on unsecured loan companies (FinTech companies) wanting to list on the ASX. The growth of unsecured lending has made inroads into the traditional loans market in Australia. Lenders certainly get to tap into this vast market, and since the bulk of Australian lending takes the shape of mortgage loans (60%), there is a gap which has given rise to a rapidly growing unsecured loans market.

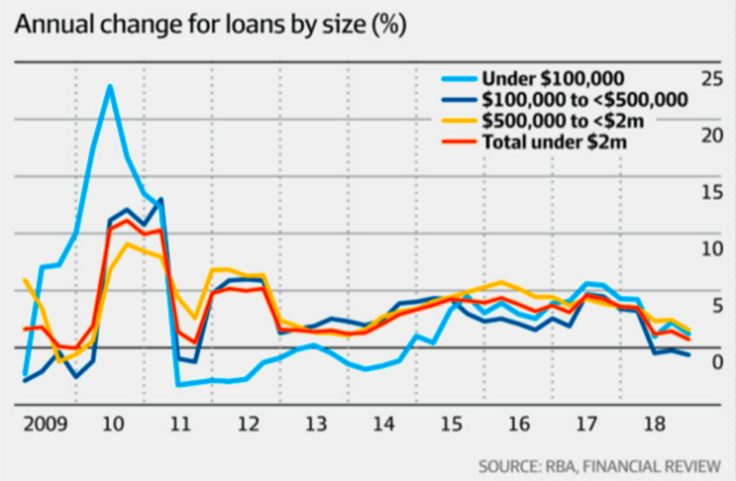

The Reserve Bank of Australia maintains that (RBA) loans to SMEs are rapidly rising, despite evidence to the contrary. A major concern is the flat-lining of property prices in Australia, with many upside-down mortgages on banks’ balance sheets. This presents as more of a concern than the growth in alternative lending.

Such is the alarm at the lack of financing available to SMEs through traditional means, that the Australian Business Securitization Fund (ABSF) was established. The stringent qualifying criteria imposed by banks on borrowers serves to hamstring business growth and to drive SMEs into the arms of eager FinTech lenders like Prospa, Capify, and OnDeck. A caveat is in order; increased lending through non-traditional means should not be left unchecked. Industry aficionados are calling for a framework of sorts to ensure that lending is not done in a haphazard manner, to the detriment of the economy, or individual lenders and borrowers.

It is worth pointing out that unsecured FinTech loans come at a premium, with much higher APRs (annual percentage rates) and overall loans costs than traditional bank loans. However, it is impossible for SMEs to run their operations without the requisite cash flow provided by these nonconventional lenders. The founders of Prospa (Bertoli and Moshal) claim that the company has lent over AU$750 million, with an average loan size of AU$25,000, to 15,000 customers since 2011 (2018 figures). With interest rates between 10% – 20%, and most of the loans unsecured, the company has maintained massive profitability and a steady and growing base of clients.