Google’s revenue surges 13% in 3Q driven by mobile searches

Alphabet Inc., parent holding company of Google, announced on Thursday the company's financial results for the quarter that ended Sep. 30 as it existed prior to its reorganisation on Oct. 2.

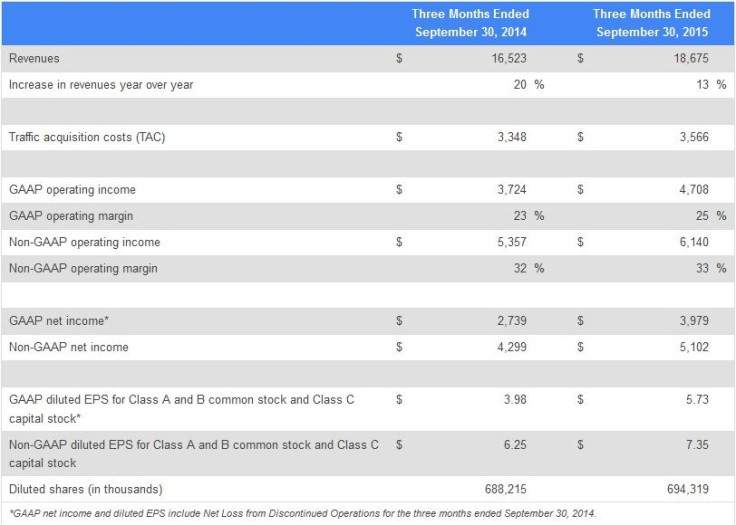

The results showed Google’s third-quarter revenue increased 13 percent, compared to the same quarter in 2014, to US$ 18.7 billion (AU$25.72 billion), which was up by 21 percent without currency fluctuations. Net income in the third quarter surged to US$4 billion (AU$5.50 billion), compared to US$2.7 billion (AU$3.71 billion) a year ago.

“Our Q3 results show the strength of Google's business, particularly in mobile search. With six products now having more than 1 billion users globally, we're excited about the opportunities ahead of Google, and across Alphabet,” said Ruth Porat, CFO of Alphabet and Google.

The third-quarter report was significant because it showed Google’s big leap in the all important mobile-device market, with earnings crossing 45 percent to nearly US$4 billion (AU$5.5 billion).

Share buyback

The new holding company that replaced Google as a publicly traded stock in October, Alphabet, also announced plans to buy back shares over an undefined period. It will spend nearly US$5.1 billion (AU$7 billion) on that. This is the first time in the history of Google’s 11-year existence as a publicly traded company that it will be buying back its stocks.

For many analysts, the third quarter result is like a pointer on how Google's core business will look like without its long-term projects, which has not been making great money.

“This is the appetiser, and the main meal comes next quarter when they report the new corporate structure,” said Ben Schachter, an analyst with Macquarie Securities, reports The New York Times.

Sundar Pichai, Google’s new chief executive, was upbeat, noting that products such as Search, Android, Maps, Chrome and YouTube have earned more than a billion users and Google Play also crossed that milestone in Q3. According to Pichai, what the most exciting was “we’re just beginning to scratch the surface.”

Exceeds expectations

What has been striking with Google’s Q3 earnings is that its revenue exceeded all projections made by analysts. Non-GAAP earnings came out at US$7.35 per share (AU$10.11) on a revenue of US$18.7 billion (AU$29.9 billion). But analysts were expecting earnings of US$7.21 (AU$9.91) per share with US$18.53 billion (AU$25.48 billion) in revenue, noted ZD Net.

For the current quarter, analysts are forecasting non-GAAP earnings of US$8.08 (AU$11.2) per share and a revenue of US$20.61 billion (AU$28.5 billion).

It may be noted that Google shares, trading under the name Alphabet Inc., still have the GOOG ticker symbol. They are up by 25 percent in 2015, as investors carry the belief that Google’s core business will be ever impressive once all money-losing projects are hived off.

For feedback/comments, contact the writer at feedback@ibtimes.com.au or let us know what you think below.