Cyclone Alfred Alert: Essential Insurance Tips To Secure Your Coverage Before Landfall

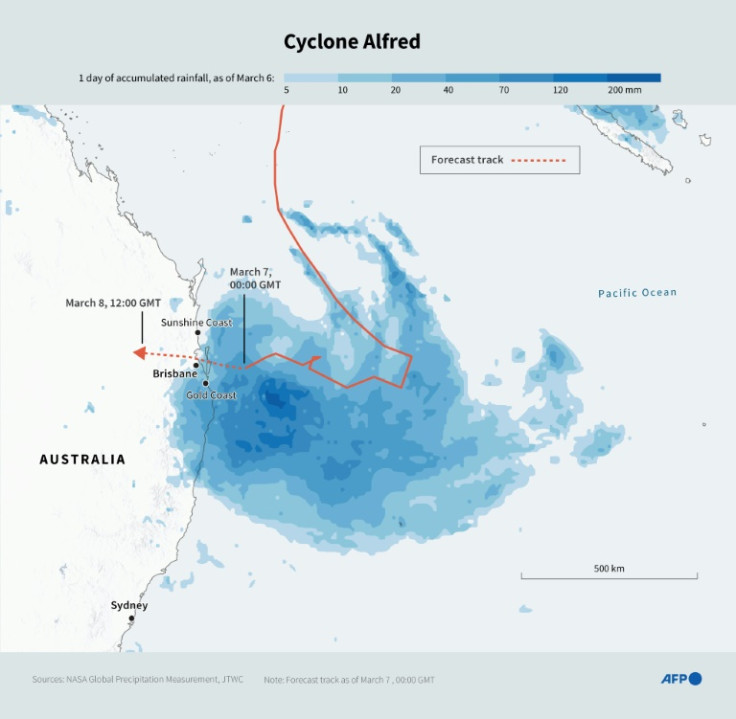

Cyclone Alfred is forecast to make landfall on Saturday along the southeast Queensland coast, bringing several days of severe weather, including extreme winds, heavy rainfall, flash flooding, and storm surges, and potentially triggering hundreds of thousands of insurance claims.

As the cyclone is expected to cause billions of dollars in damage, insurers have reassured customers that they are prepared to offer support.

"I'm confident that the insurance companies know what they need to do, I'm confident that they're putting in place the arrangements to process lots of claims," Treasurer Jim Chalmers told ABC radio on Thursday. "I'll obviously stay in pretty frequent contact with the CEOs to make sure that's the case."

In 2022, when devastating floods hit four states, many policyholders experienced long delays in having their claims processed, with some waiting up to two years. An inquiry found that many cases were "badly mishandled" by insurers. Claims were often underpaid, and some were unreasonably denied. Additionally, insurers relied on expert reports of questionable quality.

What to know before Cyclone Alfred hits

Here are some expert-offered tips on how to ensure a smoother insurance claim process.

- If you don't already have insurance but were hoping to sign up before Cyclone Alfred arrives, it's important to know that insurers often place embargoes on new policies when a disaster is imminent, ABC News reported. This is to prevent people from purchasing coverage when the risks are higher.

- For those already insured, it's essential to understand your coverage and the differences between types of cyclone damage.

- Are you covered for flood damage, storm damage, or both? Some flood coverage doesn't cover all types of inundation, such as flooding caused by storm surges. Always read the fine print to avoid surprises.

- Also, know the maximum amounts your insurer will pay for different types of damage and get a physical copy of your insurance policy in case you lose access to your digital records during the cyclone. Make sure to note down your insurer's emergency claim contact details.

Prepare photos for cyclone insurance claim

David Keane, a consumer advocate in the insurance claims industry, recommends taking a comprehensive video or as many photos as possible, covering the interior and exterior of your house.

Documenting your property before the cyclone hits is crucial for a smooth claims process. Take photos and videos showing the preparations you made, such as securing outdoor furniture or parking your car in a safe location.

Documenting how well you've maintained your property is also important, so keep records of any recent repairs or improvements, such as a roof replacement in the past 10 years.

How to prepare for a contents insurance claim

For contents insurance claims, make a detailed list of all your possessions, especially valuable items like jewelry, electronics, and antiques.

Take clear photos or videos of these items and include any receipts and serial numbers. Store all this information digitally in a cloud system or another secure location.

If you don't have time to photograph every item, consider doing a room-by-room inventory. Open wardrobes and kitchen cabinets to capture all the items in those spaces as well.

How to prepare if you are a renter

If you're renting, your landlord or real estate agent may ask you to take photos of the property before the cyclone hits, or they may rely on photos taken during the last inspection. However, it's important to remember that the landlord is responsible for maintenance and repairs needed to make the property livable again after the cyclone.

Landlord insurance will not cover your personal property, so it's up to you to protect your belongings with contents insurance.

Can you prepare for an insurance claim during the cyclone?

Personal safety is the top priority when a cyclone strikes. However, if it's safe, you can still take photos or videos of how the weather is impacting your property, but make sure you avoid any risk.

When should you make a claim?

Make your insurance claims as soon as possible after the cyclone. Don't attempt or authorize any building work, including emergency repairs, without written permission from your insurer, as this may not be covered by your policy.

Even if you're unsure whether your policy covers certain damage, it's better to make the claim anyway.

Be sure to inform your insurer if you are vulnerable, such as being elderly, disabled, experiencing trauma from the cyclone, or if English is your second language. Insurers are obligated to work with you and offer options if you're facing hardships, such as being unable to pay the excess.

How to communicate with your insurance company

It's crucial to be informed and careful when dealing with your insurer. Make sure you fully understand the coverage you have, according to Bria Sydney, a recovery support worker.

If your policy only covers storm damage, avoid mentioning "flood" during discussions, as this could complicate your claim. You'll need to prove that any water damage came from the roof, windows, or ceiling rather than flooding from the ground.

Always ask your insurer to follow up with an email summarizing your conversation and any actions that will be taken. It's also a good idea to keep your own notes of every conversation.

Your rights when claiming insurance

You have the right to view any documents your insurer is relying on to assess your claim.

Always ask to see these documents. If possible, get your own independent reports and quotes to support your claim.

© Copyright 2026 IBTimes AU. All rights reserved.