Most of the vim and vigour for the local market was seen within the first few hours of trade today. During this time sellers trampled on the gains of yesterday and for the remainder of the session the market ebbed and flowed within sight of the lows of the session. The tone of the session deteriorated after a late push was made by sellers which succeeded in pushing the market to new lows for the day. The ASX 200 after trading at 5378.3points at midday closed the session slightly lower by 0.7 of ...

Vatican has done the unimaginable and impossible on Tuesday when it placed under house custody former Dominican Ambassador Josef Wesolowski over pedophilia charges. It was the first time the Vatican has ever executed an arrest in its ranks inside the city state.

Cases of Ebola infections in Liberia and Sierra Leone could reach millions as early as January 2015.

The most pressing question for market participants ahead of Wednesday's trading session was whether the ASX 200 could sustain the gains that were made a day earlier. To the disappointment of optimists, the answer was one offer almost immediately. Sellers pushed the index down 10 points at the first trade. The market was down 25 points before there were any visible signs that buyers were making some form of effort. At the lows of the morning the index had shed just over 52 points. Thereafter a...

Syrian President Bashar al-Assad was informed of the U.S.- led airstrikes.

The global slide continues - small cap equities saw sustained downward pressure and the trend is starting to spread to the large cap space as well.

A photo of a T-shirt with an offending message became viral on Facebook and other social media sites after Filipinos criticised the manufacturer for its rape joke. The strong negative sentiment about the said apparel led Philippine mall giant SM Supermalls to pull out the item from its shelves.

About 700 miners or 7 per cent of the 10,000-strong workforce of BHP Billiton Mitsubishi Alliance (BMA) deployed in Queensland would soon lose their jobs.

Roubini Global Economics warned on Monday that Australia's economy would slow down in 2015 due to the weaker Chinese economy and trimmer Australian federal budget. It would lead to growth of only 2 per cent, more interest rate cuts and a 20 per cent decline in the value of the Aussie currency.

Opening trade for local stocks saw sellers remain with the upper hand in terms of conviction and in psychological terms. The ASX 200 was down by 6 points at first trade and went on to post a loss of 25 points at the worst levels of the morning. However as the first hour of trade was completed and the HSBC reading on Chinese manufacturing came into focus the ambition of sellers began to fade and a bottoming out process became evident. In the face of the sustained selling pressure that has been a ...

U.S. airlines have been advised to treat all body fluids of sick passengers as infectious.

Classes finally resumed for British Columbia's half a million public school students.

The small global rout overnight will sharpen the focus on market conditions, forward expectations and market participation.

In US economic data, existing home sales fell by 1.8% to a 5.05 million annualised rate in August, short of forecasts tipping sales near 5.20 million. And the national activity index fell from 0.39 to minus 0.21 in August.

A Chinese e-commerce giant broke the 2010 IPO record set by another Sino firm, the Agricultural Bank of China, when it raised $22.1 billion capital via the share launch. On Monday, Alibaba Holdings Group (NYSE: BABA) raised $25 billion after underwriters sold 48 million more shares.

Hungry Jack's launched Flame Their McOpoly to rival Macca's Monopoly campaign.

It was a quiet day for company and economic news today which left little for participants to be inspired by, apart from raw sentiment. The sellers maintained their sense of purpose throughout the day. The market closed down again making it day 11 of 14 in the red, with the ASX 200 closing at 5363 points down 66 points or 1.29 per cent.

The Vatican has vowed to simplify the process of getting annulments in the Roman Catholic Church.

A 2 day break at the weekend has done little to dent the ambition of local sellers. Having lost almost 1.8 per cent last week, the ASX 200 opened flat although within the first half of the session the index had fallen by 20 points. Thereafter the Index plumbed new lows to be down by about 30 points at the worst levels of the morning.

Apple Inc (AAPL) is predicted to have a strong opening sales weekend in retail stores around the world. Some analysts projected lower sales figures due to limited supplies and high demand.

After the 24 hour volatility mayhem that saw the FOMC board meeting, Scottish independence vote and Alibaba IPO, today is likely to see the dust settling and a little more calm in the market.

In US economic data, the leading index rose by 0.2% in August, short of forecasts tipping a 0.4% gain. The weekly Economic Cycle Research Institute index was up 2.1% on a year ago, up from 1.7% in the previous week.

Jack Cooksey is officially the first owner of the Apple iPhone 6 in Australia by lining up all night on Thursday in Perth. However, when he was interviewed by the Today Show, his precious mark in Australian tech history was almost removed because the smartphone dropped to the floor as the nervous gadget owner struggled to open the box.

Chinese e-commerce giant Alibaba Holdings (NYSE: BABA) raised $21.8 billion on Friday when it launched its initial public offering at the New York Stock Exchange. It sold 320.1 million shares at $68, the high end of its revised price range.

A rich American leased the island of Fuga in northern Philippines for 25 years for $2 billion. The 10,000-hectare island-paradise is known for its white-sand beaches and crystal-clear blue water.

There was some evidence of sellers fatigue in early trade on Friday. Buyers were able to get some purchase helped by the fact that ASX 200 has lost 2 per cent so far this week, bringing the losses for the month to 3.5 per cent.

Air Canada's new first checked bag policy rule will come into effect on Sept 18 to bookings and later, for travel on or after Nov 2.

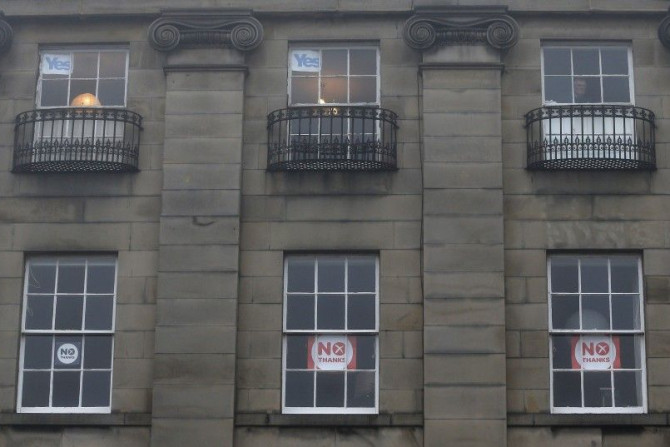

The biggest market volatility events of 2014 are almost over. The FOMC was yesterday, Scotland voting for independence is today and Alibaba, with its mass market interest, is tonight.

In US economic data, jobless claims fell by 36,000 to 280,000 last week - the lowest level since July. US housing starts fell 14.4% in August after an outsized 22.9% gain in July. US building permits fell by 5.6% in August after rising by 8.6% in July. On a more positive note, housing starts in the South (where about half of all US housing construction takes place) rose to an eight month high, while permits in the region rose to their highest level since April 2008.

Wifka, a private fraud investigation firm in Germany, was hired to investigate the July 17 downing of Malaysia Airlines Flight MH 17, which killed 298 passengers and crew on board the ill-fated plane.