Alex LaBeouf who has been working at Target in Dallas, Texas for about three months could be appearing on TV or in the movies soon.

It was a busy night for global markets, as investors digested a raft of releases and events from Europe and the US. In Europe, the BoE and ECB both kept policy unchanged. However, the latter's press conference drew significant attention, as the central bank said it expects its balance sheet to move towards 2012 levels. Essentially, this implies the balance sheet is set to increase by around a trillion euros. At the same time, the ECB reinforced its commitment to using other unconventional pol...

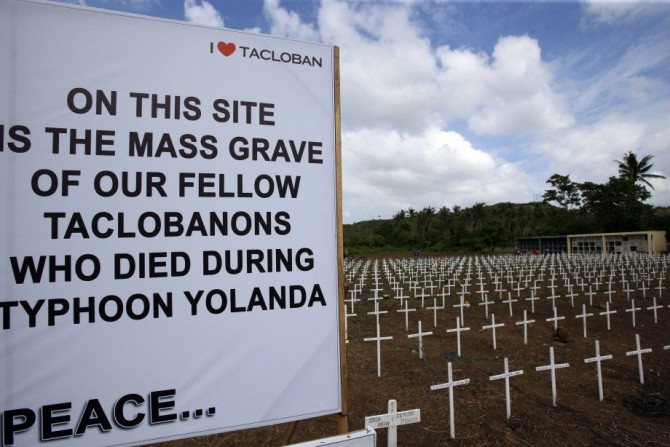

Typhoon Nuri could put parts of the United States experiencing single digit temperatures in the coming days.

In the US, jobless claim fell by 10,000 to 278,000 last week. The Labour Department also reported that hourly compensation increased at a 2.3 per cent rate in the September quarter. Labour productivity rose at a 0.3 per cent rate in the September quarter after a decline of 0.5 per cent in the June quarter.

Australia has been negotiating for 10 years with China to finalise the one-billion cattle deal.

The local sharemarket continued its downward slide this afternoon, closing firmly in the red. The All Ordinaries Index (XAO) lost 0.32 per cent or 17pts to 5,475, while the S&P/ASX 200 slipped 0.29 per cent or 16 pts to 5,501. The market was weighed down by falls in the mining and financial sectors. Volumes saw 1.9 billion shares exchanged worth $5.3 billion. 386 stocks ended higher, 571 closed lower and 321 were unchanged.

Canada and Australia have been sought by the WHO to explain their respective visa bans imposed against travellers from Ebola afflicted west African nations.

Intel Corporation announced its investment of $62 million in 16 companies marking its quest to make a mark in areas outside of chip engineering.

After several sessions where a weaker tone had prevailed locally, early trade on Thursday saw buyers re-emerge to assert themselves once again in the Australian sharemarket. The improved tone was a reflection of the gains seen in Europe and the US overnight. In Europe the FTSEurofirst 300 index rose by 1.7%, the UK FTSE gained 1.3% and the German Dax lifted by 1.6% as investors showed no anxiety ahead of the European Central Bank meeting on Thursday which is seen as bringing news of fresh stimul...

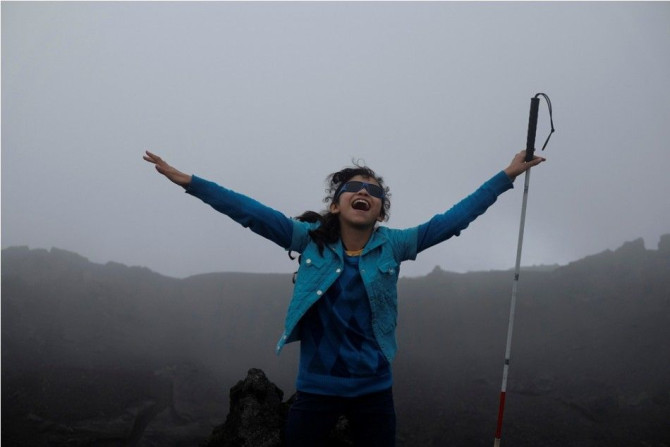

Gisele Mesnage, who is legally blind since birth, sued Coles for making it difficult for her to access its shopping website.

Amid concerns of a recession in the Euro zone, the European Commission forecasts a slow GDP growth.

Breakr claims the #AlexFromTarget viral campaign is its brainchild, but Alex himself denies it.

S&P moved to a record all-time high overnight, as the US midterms delivered their expected outcome.

It looks like the next three Olympic Games would be hosted simultaneously by Asian cities. Beijing is the strongest contender to host the 2022 Winter Games, reports said.

In the US, the ISM services index fell from 58.6 to 57.1 in October, short of estimates near 58.0. The ADP survey of private employment showed that 230,000 jobs were created in October, above estimates near 220,000. And weekly home loan commitments fell 2.6% in the latest week with new purchases up 2.6% while refinancing fell 5.5%.

A number of investors of Virgin Galactic have turned cold feet after Friday's crash.

November is always a dull month in the world of trading. US earnings season has passed, investors start to think about the new year and most macro influences slow down to a trickle.

A Sydney-bound Virgin Australia flight was forced to return to Los Angeles on Tuesday after passengers complained of a very strong and foul odor while flying.

If you want that promotion, you've got to do something.

How to get your staff to like you.

It can make you exceedingly happy -- and then land you in debt

In the US, durable goods orders fell by 1.1% in September with factory orders down by 0.6%, in line with forecasts. The trade deficit widened from US$40.1 billion to US$43.03 billion in September (forecast US$40 billion). The ISM New York index rose from 654.8 to 657.2 in October. And chain store sales were up 3.9% on a year ago in the latest week, down from 4.4% in the previous week.

The One World Trade Center opens after 13 years since 9/11.

The Australian sharemarket has ended the session firmer, after trading fairly flat for most of the day. Volumes were light with Victoria celebrating the Melbourne Cup public holiday. The S&P/ASX 200 climbed 13pts or 0.20 per cent to 5,519.

A memorial erected in Russia in honour of the late Apple founder Steve Jobs was brought down because Tim Cook outed himself as gay.

After a modest setback on Monday, the Australian share market has spent the early part of Melbourne Cup day 2014 moving higher in a restrained fashion. The flat start for the local market was a reasonable result in the face of weaker equity markets in the US and Europe. US investors were encouraged by figures showing the US ISM manufacturing index rose from 56.6 to 59.0 in October, above forecasts for a result near 56.2. European shares fell on Monday with investors disappointed by purchasing ma...

Global markets were mixed, with a predominantly risk off tone driven by a disappointing manufacturing PMI print out of China. Fed member Fisher was also on the wires suggesting he is concerned the Fed will be too late to raise rates and he was not too worried about a slight undershoot in inflation. This, along with slightly better US manufacturing data, contributed to the downward bias in equities. Europe was the hardest hit as peripheral bond yields rose, sending EUR/USD below $1.2500. This saw...

An online petition on change.org initiated by three female British students to pressure Victoria's Secret, which allegedly promotes negative body image, has gathered so far 16,000 signatures.

The four adult children of Gina Rinehart, Australia's richest person, are now evenly divided since the new lawsuit filed by the two eldest pit them against their two youngest siblings.

In the US, the ISM manufacturing index rose from 56.6 to 59.0 in October, above forecasts for a result near 56.2. Construction spending fell by 0.4% in September, whereas economists had tipped a 0.7% gain. And the six largest automakers in the US have reported October sales that were up 6% on a year ago.