Six expert predictions for China in 2016 - from its economy and share market to judicial system reform

Not a day goes by without China making international headlines. The economic powerhouse, which houses the world's largest population, is undeniably at the heart of the global economy; wielding the power to spook investors and send markets crashing with one announcement.

However, China is worthy of a more nuanced debate than the effects of its currency movements. From its efforts to fight corruption, to the country's public health challenges, how it operates internally will have worldwide ripple effects.

With all eyes fixed firmly on China, experts from the University of Sydney share their predictions for China in 2016.

1 | China’s economy

“The Chinese economy is an adolescent. A big teenager. It’s going through some extreme changes and continuing to grow, though less in terms of size and more in terms of maturity. As China and the global economy work through these growing pains, you can expect volatility across financial markets.

“Chinese policymakers expect to report 2015 growth of around 7 percent. While this would be China’s slowest economic growth in a quarter of a century, this is the ‘soft-landing’ economists had been hoping the country could engineer since annual GDP growth peaked at 14 percent in 2007. In 2016 we can expect to see further easing in China’s economic growth to around 6.7 percent.

RELATED: China's 6.9% GDP growth rate is not the hard landing feared – and Australia can benefit

“The 2016 fate of the global economy is more dependent than ever before on the direction of China. Weakening manufacturing data from China will stifle the nascent signs of economic revival in Europe, the country’s largest source of imports, and continue to drag on resource-dependent countries,including Australia.

“However, there are two major things in the second half of 2016 which could change everything. The first is China’s abolition of the one-child policy as of 1 January, the other is the ascension of the Chinese Yuan to the basket of IMF reserve currencies.

“Amidst this, there are signals of a revised battle in the decade-long currency war, with China appearing to resume devaluing the Yuan to increase the competitiveness of its exports. Expect this to lead to further international financial market instability, as Chinese investors seek out ‘safe havens’ offshore.”

- Dr Danika Wright from the University of Sydney Business School.

RELATED: Yuan’s fall could affect Australian education, properties, commodities

2 | China’s share market

“The Chinese share market is not a market because there is too much intervention by the state. Trading of stocks does not reflect their market value for corporations but rather the expected state support of prices.

“The recent fluctuations of the Chinese share market are the result of policies that introduce market elements into the stock market that reduce the implicit state guarantee of share prices. For example, companies are able to pursue hostile takeovers and radical write-downs of long-standing company values, and the government has announced facilitating the registration of newly listed companies.

“These opportunities are taken up by corporations keen to expand their control of other companies. For retail investors, this is a source of insecurity as they are price takers and too small to control the ownership of the corporations. Insecurity leads to speculation and panic selling of shares.

“Any government intervention in share prices does not solve the systemic volatility of share prices. The only solution is further marketisation that establishes corporate control over the value of companies. This is on the reform agenda of Xi Jinping’s government. But it will be a gradual process in order to avoid what happened recently. So far, the government has put too much weight on regulation and not enough on markets.”

- Professor Hans Hendrischke from the University of Sydney Business School

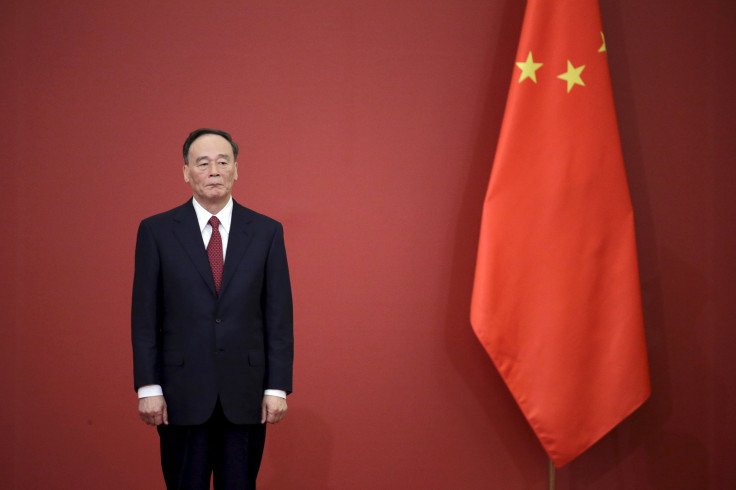

3 | Anti-corruption campaign's impact on the Communist Party

“By the beginning of 2016, the anti-corruption campaign in China has achieved one of its major political missions in removing President Xi Jinping's political adversaries and consolidating his hold on the supreme power in China. While the campaign will continue to net high-level Communist Party and government officials, it is unlikely any top-level party or state leaders, the likes of Zhou Yongkang and Ling Jihua, will be toppled for corruption in 2016.

“Now that Xi and Mr. Wang Qishan (the party's anti-corruption chief) are determined to pursue the anti-corruption campaign outside the formal legal system, the tension between the party’s disciplinary process (the principal tool for anti-corruption investigation) and the state policy for promoting socialist rule of law will become increasingly obvious. The execution of the anti-corruption initiatives has already led to growing demoralisation within the bureaucracy, and 2016 may witness more signs of a backlash within the political system.”

- Professor Bing Ling from the Sydney Law School, an expert on Chinese law

RELATED: US warns China against harassing Chinese expats over anti-corruption campaign

4 | Impact of the anti-corruption drive on corporations

“China’s anti-corruption drive shows no signs of easing off in 2016, as leaders from state-owned enterprises are targeted. As the economy slows down, foreign corporations are also likely to come under increased scrutiny under the Anti-Trust Law (which covers monopolist behaviour) and the Anti-Competition Law (which deals, among other things, with commercial bribery).”

- Professor of Chinese and International Business Law, Vivienne Bath.

RELATED: China 'expels' French journalist, says she is 'not suitable' to work in China

5 | Judicial system reform

“China’s changes to the legal and judicial system will proceed in the current bifurcated manner. Central judicial authorities on the one hand will try to implement last year’s ambitious agenda of reducing the power of local authorities over the courts, improving the procedures of the court and conduct of court proceedings and pursuing corrupt behaviour.

“Government authorities will on the other hand pursue the pattern of attempting to control lawyers and utilise the courts to silence activists and human rights lawyers for a range of offences. These conflicting activities will put a great deal of pressure on the reform process and the courts. We will probably see an increase in the activities of extra-judicial administrative authorities in terms of investigations and punishments.”

- Professor Vivienne Bath

6 | Public health challenges

“China’s rise as a major economic powerhouse has coincided with rapid health transition, from having a high burden of communicable diseases and undernutrition to non-communicable diseases now dominating the health challenges. Understandably air pollution has been the most visible and talked about public health issue for which there is no quick fix. The focus of the next five-year plan should also be on improving poor diets and tobacco use, lowering high blood pressure and cholesterol through behaviour modification.

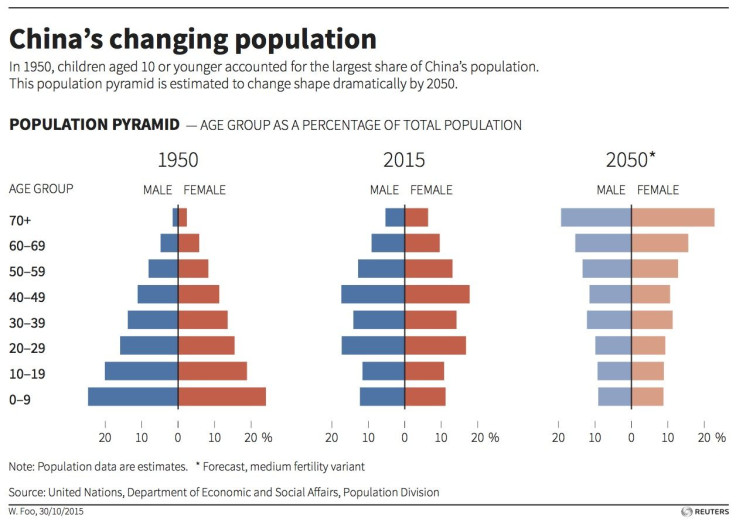

“The elderly population in China is increasing and the proportion of those over 65 years has almost doubled in the past three decades. This imposes a big challenge on the pension system and has significant implications on the demand of the country’s health system. However, the rural areas are carrying a disproportional burden of the aging population as young people have been pulled to cities and major towns for work. The rural elderly and poor do not have adequate access to quality health services and care due to the inequitable distribution of resources, which tends to favour those living in urban areas.

“It is encouraging that the Chinese government is committed to health reform and the establishment of a new old-age insurance system for urban and rural residents. There is more that needs to be done in the new five-year plan, such as improving long-term care in rural China to protect the elderly and to close the urban-rural disparities.”

- Professor Mu Li is an expert on public health in China. She has recently edited a book titled ‘Urbanisation and Public health in China’