There was a solid bounce in the US markets Friday night, as Q2 GDP was revised to 4.6% on an annualised basis from 4.2% previously.

Environment Minister Greg Hunt approved over the weekend the $2.2 billion North Galilee Basin Rail project. However, the final approval would be based on Indian mining company Adani meeting 23 conditions.

In US economic data, the final reading on US June quarter GDP was revised up from 4.2% to 4.6%. The result was in line with expectations. The major contributors were a lift in business investment and stronger exports (up 11.1% in June quarter and the biggest gain since 2010). Inflation as measured by the PCE index was unchanged at a 2.3% annual rate. The final University of Michigan Consumer Confidence reading for September held steady at 84.6 and was well ahead of the August result of 82.5.

The second half of the session on Friday saw the ASX 200 trade around the lows of the day with a sense that sellers could make an opportunistic move at any time to take the index to new lows. With the losses of recent weeks continuing to mount, the ASX 200 has now seen all of the gains for the year to date erased. At the close of the session the index is now down 1.3 per cent at 5,313.4 points. Corporate and economic news has been limited in recent days. This dearth continued into Friday leaving...

Friday morning saw a sadly familiar tale play out for the local share market once again. Selling arrived in another wave at the open after a grim session for stocks in Europe and the US overnight. European shares fell sharply on Thursday, hitting one-month lows in late trade. US share markets slumped led lower by a drop in Apple shares. Geopolitical concerns came to the fore after the Russian high court paved the way for the seizure of foreign assets. An ongoing theme was the rising US dollar wh...

It was risk off for global equities with investors focusing on geopolitical risk and repricing of fed hike expectations. While both these themes have been known for a while, it seems the fact price action just continues to deteriorate is discouraging investors from jumping back into equities.

In US economic data, durable goods orders fell by a record 18.2% in August after lifting by a record 22.5% in July. The fall was in line with expectation (-18%). Excluding volatile transportations orders rose 0.7% in August. US jobless claims rose by 12,000 to 293,000 in the past week. US flash composite PMI eased from 59.7 to 58.8 in September.

The influence of the strong session on Wall Street overnight faded over the course of the Asian session in general on Thursday. In form that has become typical for the Aussie market, buyers continued to withdraw over the second half of the day, and sellers retained the edge. This was best reflected in the final result which saw the ASX 200 end with a 6 point gain, having been up as much as 37 points in the first half hour of trade. The afternoon session began with another lunge from sellers as t...

The local share market continued the ebb and flow of recent days. There was a short lived flourish at the open that saw the market with a near 37 point gain at its peak in the first half hour of the session. Buyer conviction then waned and a low for the morning was put in place when the index was up almost 7 points. A level to keep in mind in terms of support for the ASX 200 for the remainder of the week is the area around 5338, which is the low that was made in a push lower during Tuesday's ...

The S&P is yet to experience four consecutive days in the red this year after closing in the green overnight.

In US economic data, new home sales surged by a surprising18% in August to a seasonally adjusted rate of 504,000 units - the highest level in six years. Despite the rise in sales the stock of new houses lifted to a four-year high. At August's sales pace it would take 4.8 months to clear the supply of houses on the market.

Most of the vim and vigour for the local market was seen within the first few hours of trade today. During this time sellers trampled on the gains of yesterday and for the remainder of the session the market ebbed and flowed within sight of the lows of the session. The tone of the session deteriorated after a late push was made by sellers which succeeded in pushing the market to new lows for the day. The ASX 200 after trading at 5378.3points at midday closed the session slightly lower by 0.7 of ...

The most pressing question for market participants ahead of Wednesday's trading session was whether the ASX 200 could sustain the gains that were made a day earlier. To the disappointment of optimists, the answer was one offer almost immediately. Sellers pushed the index down 10 points at the first trade. The market was down 25 points before there were any visible signs that buyers were making some form of effort. At the lows of the morning the index had shed just over 52 points. Thereafter a...

Syrian President Bashar al-Assad was informed of the U.S.- led airstrikes.

The global slide continues - small cap equities saw sustained downward pressure and the trend is starting to spread to the large cap space as well.

Opening trade for local stocks saw sellers remain with the upper hand in terms of conviction and in psychological terms. The ASX 200 was down by 6 points at first trade and went on to post a loss of 25 points at the worst levels of the morning. However as the first hour of trade was completed and the HSBC reading on Chinese manufacturing came into focus the ambition of sellers began to fade and a bottoming out process became evident. In the face of the sustained selling pressure that has been a ...

The small global rout overnight will sharpen the focus on market conditions, forward expectations and market participation.

In US economic data, existing home sales fell by 1.8% to a 5.05 million annualised rate in August, short of forecasts tipping sales near 5.20 million. And the national activity index fell from 0.39 to minus 0.21 in August.

It was a quiet day for company and economic news today which left little for participants to be inspired by, apart from raw sentiment. The sellers maintained their sense of purpose throughout the day. The market closed down again making it day 11 of 14 in the red, with the ASX 200 closing at 5363 points down 66 points or 1.29 per cent.

A 2 day break at the weekend has done little to dent the ambition of local sellers. Having lost almost 1.8 per cent last week, the ASX 200 opened flat although within the first half of the session the index had fallen by 20 points. Thereafter the Index plumbed new lows to be down by about 30 points at the worst levels of the morning.

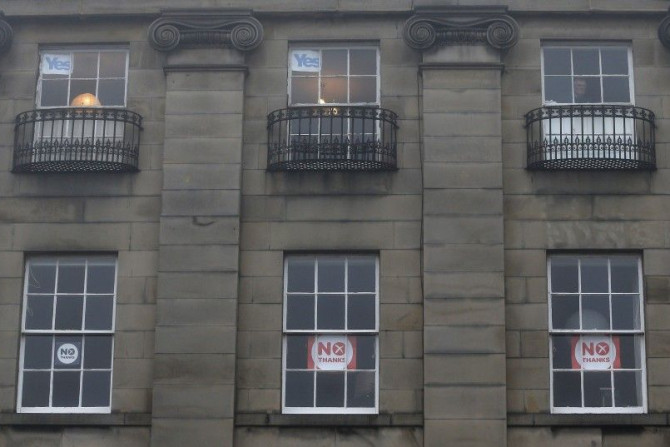

After the 24 hour volatility mayhem that saw the FOMC board meeting, Scottish independence vote and Alibaba IPO, today is likely to see the dust settling and a little more calm in the market.

In US economic data, the leading index rose by 0.2% in August, short of forecasts tipping a 0.4% gain. The weekly Economic Cycle Research Institute index was up 2.1% on a year ago, up from 1.7% in the previous week.

Chinese e-commerce giant Alibaba Holdings (NYSE: BABA) raised $21.8 billion on Friday when it launched its initial public offering at the New York Stock Exchange. It sold 320.1 million shares at $68, the high end of its revised price range.

A rich American leased the island of Fuga in northern Philippines for 25 years for $2 billion. The 10,000-hectare island-paradise is known for its white-sand beaches and crystal-clear blue water.

There was some evidence of sellers fatigue in early trade on Friday. Buyers were able to get some purchase helped by the fact that ASX 200 has lost 2 per cent so far this week, bringing the losses for the month to 3.5 per cent.

The biggest market volatility events of 2014 are almost over. The FOMC was yesterday, Scotland voting for independence is today and Alibaba, with its mass market interest, is tonight.

In US economic data, jobless claims fell by 36,000 to 280,000 last week - the lowest level since July. US housing starts fell 14.4% in August after an outsized 22.9% gain in July. US building permits fell by 5.6% in August after rising by 8.6% in July. On a more positive note, housing starts in the South (where about half of all US housing construction takes place) rose to an eight month high, while permits in the region rose to their highest level since April 2008.

Wifka, a private fraud investigation firm in Germany, was hired to investigate the July 17 downing of Malaysia Airlines Flight MH 17, which killed 298 passengers and crew on board the ill-fated plane.

At the end of a day which saw a stronger start the Aussie market has recovered after its lunchtime slump, closing slightly higher and thus ending a six day losing streak. The All Ordinaries Index (XAO) closed at 5419 points up 0.14%.

Despite a firmer start this morning, the Australian sharemarket is trading at its lowest level since 2 July at lunch. The All Ordinaries Index (XAO) is below the key 5400pt mark, is down for the seventh day and this is the worst week for local markets in 15 months. Volume iselevated partly due to index option expiry today which tends to result in a volume spike.