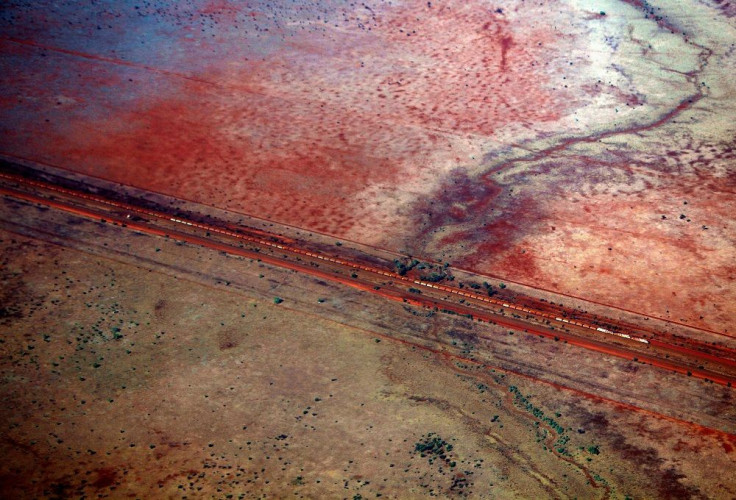

Iron ore price jumps to $60.90, hits 3-month high

A week after iron ore price dipped to US$58.80 (A$77.41) a tonne because of increased stockpiles in China, price of the key steelmaking-ingredient rose on Monday to US$60.90 (A$80.03). Not only did the 3.4 percent hike broke the US$60 threshold, it also established a three-month high record.

The Australian reports that the increase in price of the commodity boosted the mining sector in London with shareprice of giant miners BHP Billiton (ASX: BHP) jumping to US$58.90 (A$77.39) and Rio Tinto (ASX: RIO) to US$60.70 (A$79.72) from the previous day’s trade. The behaviour of the commodity’s prices has gone against analysts’ expectations.

The short-term price hike for BHP, Rio and Fortescue Metals Group (ASX: FMG) is the result of lower costs of miners and robust prices, explains broker Ord Minnett. This development allows the miners “to enjoy extremely strong near term free cash flow,” analysts of Ord Minnett wrote in a research note.

Taking into account Rio’s recent financial report, Ord Minnett analysts say Fortescue shares remain the best bet because among the three giant miners, it has the strongest cost-cutting momentum, while improving productivity and processing higher impurity iron into steel of the same quality.

The slight recovery of iron ore price pales in comparison to the peak price of US$175 (A$229.83) five years ago, notes Motley Fool. The website says price of the commodity is a serious matter for the three because it contributes 33 percent of BHP’s group revenue, 41 percent for Rio and 79 percent for Fortescue.

As a result of plunging iron ore prices on the long-term, shareprices of the three had dipped by 43.7 percent for BHP, 31.2 percent for Rio and 20.5 percent for Fortescue. Besides the weaker stock, the website says the Australian government’s recent slashing of iron ore price forecast is good enough reason to avoid buying stocks of the three giant miners for now.

VIDEO: Have steel and iron ore prices bottomed? – David Clarke, head of strategy

Source: ArcelorMittal corporate