Australian regulators simply handed down a huge financial windfall to SingTel Optus in green lighting the telco's $800-million deal with NBN Co, which will soon lead to the progressive retirement of Optus' hybrid fibre-coaxial (HFC) network in Brisbane, Melbourne and Sydney.

It won't be long before the Chinese yuan, or renminbi, becomes Asia's regional currency, what with the number of trade transactions using China's currency as preferred mode of financial settlement.

It was a very painful, not to mention, a very steep price to pay. Australia has now become a laughing stock that after awarding a $34 million subsidy for Ford Australia and expecting 300 jobs in return, the complete opposite happened when the automaker announced its 440 job cuts earlier this week.

Global Anglo-Australian mining giant Rio Tinto PLC will be conducting a manpower downsizing at its Clermont mine in Queensland, Australia, set off by a double whammy rising domestic costs and continued lower world prices in the Asian market.

Debt-riddled Australian media company Nine Entertainment Co had gotten another potential bidder, this time for a A$3 billion ($3.1 billion) buyout by one of the world's largest private equity groups, TPG.

Another trigger event is all it will take for a repeat of the riots that plagued London and other cities across the country last summer, according to an expert from Royal Holloway, University of London.

The Australian Navy burned on Thursday two asylum boats used to ferry 51 passengers from Sri Lanka and 65 from Indonesia. The torching rite, witnessed by The Advertiser, was held 20 nautical miles of Christmas Island which is often the port of destination of the asylum vessels.

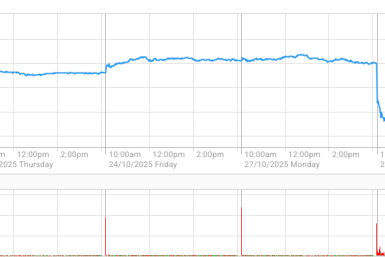

Bell FX Currency Outlook: The Australian Dollar has

continued its run higher overnight reaching six week

highs, as US dollar weakness and global factors

continue to drive the AUD higher.

Technology shares rallied on better-than-expected earnings reports from International Business Machines and others, overshadowing a disappointing round of economic data to push U.S. stocks higher. The Dow Jones Industrial Average rose 34.66 points, or 0.27%, to 12943.36, its third-straight daily advance.

The rigorous environmental assessment phase had compelled Toro Energy Ltd to push back and revise its initial target date for a final board decision on what could be Western Australia's first uranium mine project.

The fate of Julia Gillard as Labor leader was discussed in passing during the Tuesday meeting of union leaders in Melbourne this week, according to a report by Fairfax Media today.

Australia's mining boom, with its consequent manpower shortage, has forced the country to make more permanent residents of the Indian and Chinese migrants that came in the year to June, 2012, the government said on Thursday.

Victoria could be facing its biggest teachers' strike in September, a first in history.The Australian Education Union (AEU) has submitted an application with Fair Work Australia on Thursday for a protected action ballot to allow its 7,000 non-teaching support staff to join state school teachers for a 24-hour work stoppage planned for the first week of September.

Investors pushed stocks sharply higher Wednesday, erasing all of July's losses, as investors reacted to strong corporate earnings and continued hopes for central-bank intervention. The Dow Jones Industrial Average rose 103.16 points, or 0.81%, to 12908.70, while the Standard & Poor's 500-stock index tacked on 9.11 points, or 0.67%, to 1372.78--bringing that index to within a hair of a fresh two-month high.

Australia: The AUD made a decisive push towards USD1.0400 overnight and is still holding fairly strong around USD1.0360 following a lead from offshore equity markets, a rise in commodity prices and a lack of negative developments out of Europe boosting investor optimism.

Fresnillo PLC, a Mexican precious metals miner, on Wednesday announced it remained confident of achieving the gold and silver production targets it has set for 2012, after second quarter output showed favorable results.

Ms Gillard said on Wednesday she was surprised that there "is a new low in negativity even for Mr Abbott."

While the proposed $33-billion expansion of the Olympic Dam copper and uranium mine project will surely add greatly to the coffers of Roxby Downs, making it self-sufficient in the long-term, the same could not be said as far as adequate housing accommodations is concerned.

That rare earths mining firms operating in Australia as well as in the U.S., Canada and other African nations will scramble to meet the impending supply import demand of China for the precious elements is no remote possibility.

Global tech retailers sell their products in Australia with unjustifiable higher price tags when compared to other key markets, according to consumer advocate group Choice.

Downstream industries highly dependent on rare earths elements are now seeking substitutes by way of sythetically producing the material.

A heavy rare earths bearing mineral eudialyte, which could later on produce the rare earths elements yttrium and zirconium, has been positively confirmed discovered outside of Matamec's Kipawa heavy rare earth deposit in Quebec, Canada.

Overnight European market closed slightly lower after a weak business confidence report out of Germany. In the U.S. the stock markets moved higher, while gold and metal prices sold off. Overnight the Federal Reserve Chairman Ben Bernanke said the U.S. economy was weak but the FED did not plan on to take any further action at present to boost the economy.

A newly launched discussion paper on food security recommended that Australia be open to more foreign investors in its agriculture sector to ensure the long-term viability of domestic supply and boost food export.

Bell FX Currency Outlook: The Australian Dollar remains

stronger this morning having outperformed both the

EUR and NZD in the process.

Stocks shook off the Fed chief's dour view of the state of U.S. growth, reversing early losses on hopes central bankers might be forced to come to the economy's aid. The Dow Jones Industrial Average rose 78.33 points, or 0.6%, to 12805.54.

The Australian sharemarket improved for the third straight day today, something which hasn't happened since the end of last month. The All Ordinaries Index (XAO) rose 0.8 pct or 32.1 pts to 4175.3. Despite the gains, investors continued to be uninterested in markets, with yet another quiet session when it comes to the number and value of shares exchanging hands.

China, in yet another endeavor to loop-thread and consolidate its patchy rare earths mining sector, has decreased in half the approval and release of mining rights it can award to producers and mining firms.

After a decade-long battle, media giant News Ltd has finally scored a win against the Australian Taxation Office (ATO) to its over more than A$2 billion ($2 billion) in tax deductions.

Victoria is facing more job cuts in the following months as automaker Ford Motors Co. on Tuesday announced it will slash more than 440 jobs at its Geelong and Broadmeadows production plants.