Liv @ Mb Joins The Ranks Of Rare Premium Real Estate In Singapore

- Singapore has tackled the challenge of housing shortages and minimal land through clever policies and initiatives.

- Liv @ Mb is a development that is rooting itself in the premium housing market.

- The premium real estate market has continued to see expansion despite the shortage of land in premium locations.

In a piece titled, ‘ A home for everyone: Singapore's public housing ’, the Singaporean government announced that as a result of governmental planning and budgets, “80 percent of new flat buyers today can afford their first flat without paying any cash out-of-pocket for mortgage installments.” This however, does not mean that the average person from Singapore has access to premium locations or housing. This address predominantly speaks to the efforts of the government to provide affordable housing to individuals within a certain income bracket.

Similarly, Singapore’s Voluntary National Review Report to the 2018 UN High Level Political Forum on Sustainable Development, highlighted the primary challenges facing Singapore’s land and home ownership: limited land, and high urban density. Singapore has largely risen to these challenges, by creating policies and initiatives that promote creativity in the housing space.

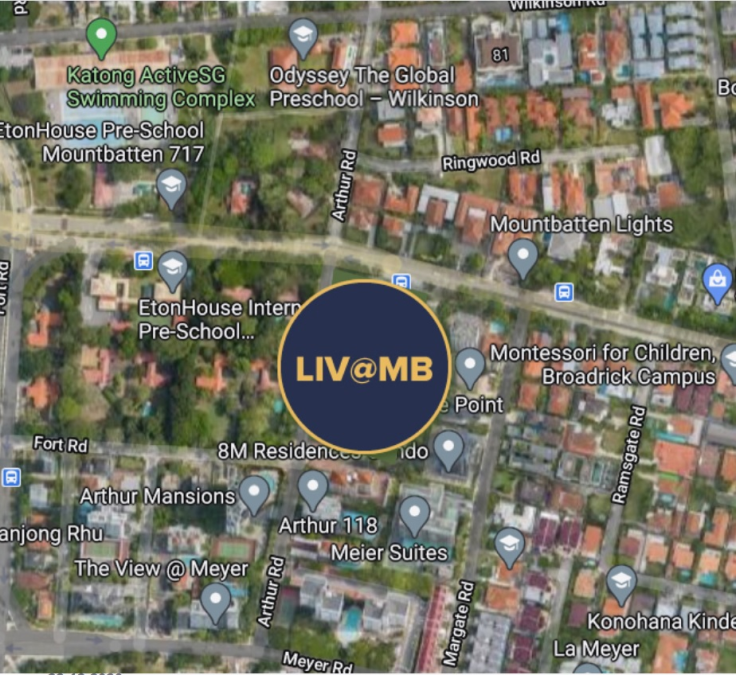

Liv @ Mb is a property development in Singapore that has tapped into the premium real estate market through ingenuity and accomplishment. This market is typically very rare in Singapore, however, the developer has tremendous experience in prime locations such as District 9 and 10. This particular development is situated at Mountbatten - a premium neighborhood.

Singapore’s Housing Market

Singapore’s housing market consists largely of housing which has been built by the government for Singaporean people. The Housing and Development Board (HDB) controls the manner in which new housing projects are established. The HDB also provides significant subsidies to first-time home buyers. These subsidies are provided on top of the discount which the HDB offers as it prices the flats at below market rates.

This makes housing easy to acquire in Singapore, which is why it is a nation with one of the world's highest homeownership rates. Families who are first time home buyers can get a subsidy of up to $160 000 for flats which are being resold. These government initiatives were started in the 1960s to solve the nation's housing crisis.

All of the public housing which Singapore has invested in does not mean that there is not a thriving private market for real estate. Many premium locations in Singapore are left to the private sector to explore. This opens up key investment opportunities for investors looking to advance and diversify their portfolios.

Investors looking to invest in the Singaporean real estate market may be concerned about the new property taxes which have recently been implemented. However, this is not a cause for concern. These property taxes will only have a substantial effect on the higher end of the market and, even then, the increase in costs will be low relative to other countries in which investment properties are popular.

This is evidenced by the fact that higher property taxes in other countries which are popular for investment properties did little to curtail the interest of long term foreign investors. In Canada and the UK higher property taxes were imposed but this did not deter long term investors. Especially those interested in property in countries where the human development index and GDP per capita is high. This definitely includes Singapore.

An additional feature of Singapore which makes it attractive to foreigner investors is the high rents which Singaporean people pay. Rents have only increased in 2021, which further increases the lucrative nature of investment in Singapore. Due to the incredibly constrained land availability in Singapore, rentals are projected to continue to rise further in coming years.

Joining The Ranks Of Premium Singapore Real Estate

A much sought after development which joined the ranks of the premium real estate market in Singapore is Liv @ Mb. This development satisfies the high requirements of premium real estate. The development is situated close to other premium real estate. This is in addition to the proximity of the development to reputable schools and an abundance of shopping centers. The development is also close to many trendy bars and restaurants for added convenience.

Liv @ Mb, consisting of two towers with 298 luxury units and penthouses, poses as an interesting and compelling investment opportunity. It is a rare real estate investment in a country that is primarily comprised of affordable housing that does not meet the standards of premium real estate.

Premium housing is a somewhat untapped market in Singapore, and Liv @ Mb could position itself as a leading development in the luxury/prime real estate space.

With investors more cautious than ever about the U.K. and E.U. as safe havens and a growing lack of trust given geopolitical tensions over Russia and Ukraine, it is clear why many turn to Singapore, Hong Kong and elsewhere in search of a new home for their capital. Already prior to the issues the world faces today, Singapore was considered “The Switzerland of Asia” - and today, that could not be more true.

Final Thoughts

The Singaporean housing market is known to offer a mix of sustainable rental yields, a safe haven in Asia during a time when Eurasian investors might be cautious of the UK and Europe. Just consider how the U.K. and Italy acted with sanctions and appropriation of property belonging to high networth individuals from the U.A.E, Hong Kong and elsewhere in Eurasia: this is another reason why Singapore is considered a safe haven in a new multipolar world. Singapore is largely dominated by public housing built for the betterment of the nation's people. This has not stopped the private sector from developing premium real estate for the discerning investor. Singapore remains a compelling option for foreign investors as the nation’s economic and political stability will continue to drive its economic growth. This in turn, will continue to drive property value in Singapore in conjunction with the increasing international demand for its real estate.