GDP Shows Modest Increase In Q3

The Bureau of Economic Analysis reported a gross domestic product increase of an annual rate of 2.1% in Q3, down from 6.7% in Q2 and 6.3% in Q1, the U.S. Department of Commerce announced Wednesday. Initial estimates put the GDP at 2% for Q3.

The report cites a reimplementing of COVID-19 restrictions in parts of the country where cases are rising while loans to businesses, state grants, and household social benefits decreased or stopped entirely.

If rise in COVID-19 cases and the effects of inflation are minimal, then economists expect a solid rebound for Q4, the current quarter, according to AP News.

Economists expect that this latest rise in COVID-19 cases, specifically the Delta variant, will not have as much of an effect on consumer spending, which accounts for 70% of economic activity.

“I think each new wave of COVID cases will be less disruptive to the economy because more people are getting vaccinated,” Mark Zandi, chief economist at Moody’s Analytics, told AP News.

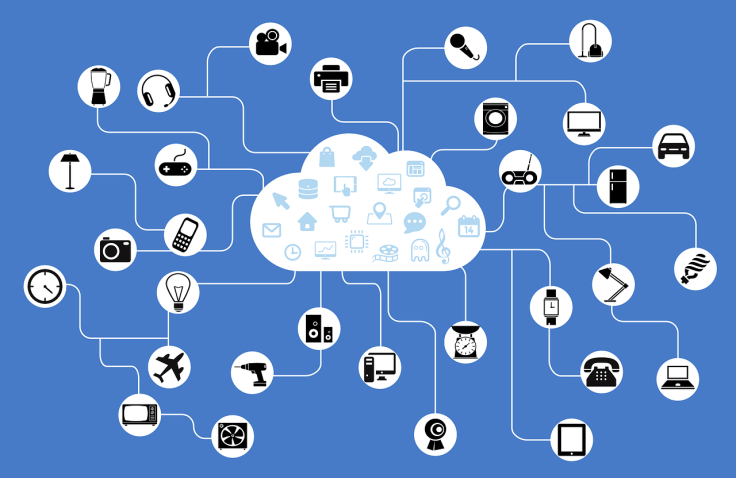

McKinsey IoT 2030 Forecast: MachineFi Economy Explosion is Coming

Photo: Pixabay

Dan North, a senior economist at Euler Hermes North America, explained to International Business Times (IBT) that “Q3 GDP fell asleep at the wheel” but indicators pointed to a strong Q4.

“What I have seen is an upturn in high-frequency indicators such as credit card spending, TSA throughput, OpenTable reservations, and hotel occupancy. All of those took a dip in Q3 when the Delta variant peaked, which the GDP report confirmed, and they are all turning positive again,” North wrote in an email to IBT.

However, there are multiple factors that could still hinder the economy. Inflation, supply chain delays and supply shortages, rising COVID-19 cases, and labor shortages because of high resignation rates could still affect predictions for a strong Q4.