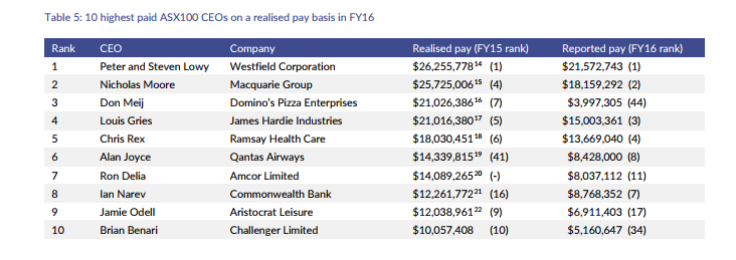

Australia: 10 highest paid ASX100 CEOs on a realised pay basis

The Australian Council of Superannuation Investors has released a list of the highest paid CEOs in 2016. Based on a CEO survey, Westfield Corporation co-chief executives Peter and Steven Lowy are the highest paid executives, earning $26.3 million between them in 2016. Macquarie Group chief executive Nicholas Moore is next on the list, taking home up to $18.2 million last year.

CEO at Australia’s biggest companies is being paid 90 times more than the average. The average realised pay for ASX100 CEOs last year was $5.7 million, the new survey by the Australian Council of Superannuation Investors found. This is nearly 93 times the average pay packet of $61,308 annually. Excluding the bonuses, median ASX100 fixed pay for chief executives was $1.79 million.

The figure was up 4.4 percent last year but well below prior-year peaks. It was almost $1.95 million in 2012.

At the moment, the country’s wage growth is suppressed. Annual growth in the Wage Price Index was only at 2.03 percent in the June quarter.

It was the weakest level recorded since the Australian Bureau of Statistics first conducted the survey in 1997. The report has also confirmed the supremacy of male chief executives in the ASX 100, which prevented the inclusion of data regarding gender diversity in CEO pay.

CEO bonuses

Louise Davidson, ACSI chief executive, has expressed concern about why only 18 percent of CEOs obtained less than half of their potential bonus, given the dissatisfaction toward some corporate performances."Investors reasonably assume that bonuses will only be awarded for exceptional performance over and above normal expectations," The ABC quotes her as saying.

Davidson argued it was hard for CEOs to miss out on a bonus. The occurrence of CEO bonuses at constantly high levels reportedly leads to serious concerns about the way performance hurdles are designed and applied.

"We can't help wondering why these executives would have qualified for any payments in the first place," Davidson said as she pointed at the lacklustre performance of some companies. She said they could not help but wonder why some executives would have qualified for payments to begin with.

The Commonwealth Bank board has opted to cut the bonus of chief executive Ian Narev to zero amid the money-laundering allegations he is facing. Davidson has welcomed this move, saying it is good to see boards getting on the front foot.

VICE News/YouTube