Why CEOs fail: Australia has embraced the outsider CEO, but they can't always save the day

Companies in distress often recruit a new chief executive officer (CEO) from outside the firm. It looks like Woolworths is currently heading down this path, as could the National Rugby League. It’s also been a succession strategy at telecommunications giants Vodafone and Telstra.

The underlying idea seems straightforward: find a highly skilled individual with no vested interests, pay them generously, and let them make the tough decisions needed to change the status quo.

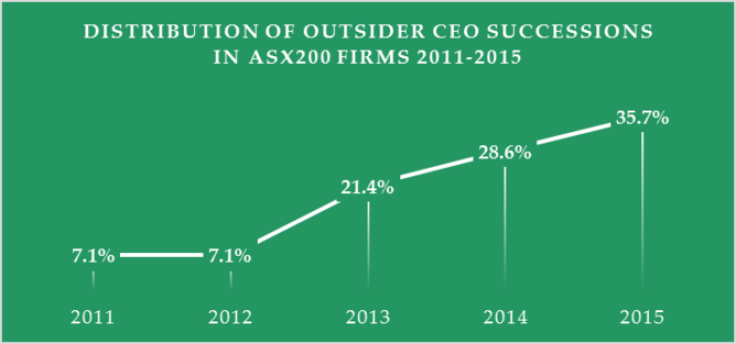

Mirroring developments in the US and Europe, our analysis of ExecuComp data reveals that ASX200 firms are increasingly embracing the outsider corporate CEO. In fact, over a third of ASX200 outsider CEO hires in the last five years took place in 2015. This represents an increase of almost 25% compared to 2014.

Almost two thirds (64 percent) of the outsider CEOs hired in that period took over firms that had experienced an average drop in share price of 27 percent for the three years preceding their appointment (according to Yahoo Finance data).

Today, global players like Credit Suisse and Unilever attribute their improved market presence to their successful outside CEOs. Yet, evidence on the success rate of this CEO succession strategy tells a more cautionary tale.

Studies show that outsiders have a higher likelihood of getting dismissed within the first three years of taking on the job. Evidence from large US organisations further shows that outsider CEOs often fail to deliver the expected turnaround of the organisation.

Several key lessons need to be embraced if corporate Australia is to continue this trend of hiring outsiders to save the day.

Why some outsider CEOs ‘fail’

It usually takes a new CEO at least two years to have a visible imprint on the organisation’s strategy. However, impatient shareholders and analysts demand quicker results given the hefty salaries they pay to recruit outsiders. Due to the pressure to demonstrate immediate results, these CEOs end up making grandiose decisions that often lead to even poorer performance.

CEO turnover is also often paired with attrition of top executives - especially those who may have been passed over for the job. Yet, the success of CEOs rests heavily on the experience of the executive team they lead.

In fact, some estimates suggest that CEOs can only be credited for about 10-20 percent of their companies’ performance, with experienced executive teams supplementing another 10-20 percent. The loss of key insiders leaves the new CEO to lead a less experienced new team. Less experienced managers in turn tend to engage in more flattery and opinion conformity, withholding dissenting information that would otherwise improve the quality of the CEO’s decisions.

Good governance codes further suggest that CEOs should be appointed by directors who are independent from both the candidate and the managers of the firm. Ironically, this may be one key reason why boards make a poor selection of outside candidates.

Given the lack of up close experience with the candidate, directors often infer their presumed skillset from the observable performance of the candidate’s previous employer. Yet, this negates confounding factors, such as industry conditions or luck, that may have accounted for the candidate’s prior “success.” As a result, boards may overestimate the applicable skillset of an outsider candidate and realise the misfit only after the appointment.

Can outsiders stand a fighting chance?

Studies highlight several factors that can help the outsider CEO succession strategy succeed.

First, although outsiders are favoured by under-performing firms, a recent study showed that outsiders might be more suited for firms that are already performing well. Hiring a figurehead who is unfamiliar with the chain of decisions that led to poor prior performance often results in further financial decline.

Second, new outsider CEOs need incentive plans that stimulate long-term commitment. Yet, our analysis of ASX200 firms reveals that outsider CEOs hired between 2011 and 2015 received almost 21% less in long-term compensation compared to new insider recruits. Australian boards may need to reconsider the design of the long-term components of compensation packages to insulate the CEO from the Australian market’s myopic pressures.

Boards of directors also need to become more involved in strategy and accountable for the outcomes. To do so, boards of under-performing firms particularly need to balance arm’s length control of the CEO with in-depth collaboration and mentoring of their new CEO. To properly monitor and support the CEO, firms need to recruit a mix of directors with diverse networks and outside experience as well as deep knowledge about the firm and its history.

Rise an outsider

Corporate Australia is increasingly embracing the outsider CEO. Despite the value that outsiders could bring, boards should be careful not to expect them to be quick saviours to deep-rooted corporate woes.

By bringing outsiders into the right situation, devising attractive long-term incentives, and ensuring boards are actively involved and jointly accountable, they may just stand a chance.

Mariano L.M. Heyden, Lecturer in Strategy & Business Policy, University of Newcastle, and Dimitrios Georgakakis, Research Fellow and Lecturer in Strategy and International Management, University of St.Gallen

This article was originally published on The Conversation.