What does Australia's new 2030 climate target mean for the local coal industry?

Australian Prime Minister Tony Abbott has promised that his government’s new 2030 climate target will be good for the environment, good for jobs and good for protecting the nation’s coal industry.

After announcing Australia would reduce greenhouse gas emissions by 26-28% below 2005 levels by 2030, the prime minister was asked about what impact that could have on the local coal industry. He replied:

We are not assuming a massive close-down of coal. In fact, one of the things that will benefit the world in the years and decades to come is if there is a greater use of Australian coal, because high-quality Australian coal as opposed to low-quality local coal is going to help other countries to, if not reduce their emissions, certainly reduce their emissions intensity.

One of the reasons why China is forecast to substantially reduce its intensity, if not its overall emissions, is because it is forecast to rely increasingly on coal from countries such as Australia…

We certainly aren’t forecasting the demise of coal. Our policy doesn’t depend upon the demise of coal. In fact, the only way to protect the coal industry is to go with the sorts of policies that we have. That’s why I think our policies are not only good for the environment but very good for jobs.

Australia currently gets three-quarters of its electricity from burning coal – but most of the nation’s coal production, particularly from New South Wales and Queensland mines, is for global exports.

The Conversation asked a panel of energy experts for their forecasts for Australian coal in the light of the 2030 target and the upcoming climate talks in Paris. (You can also read why experts have warned Australia’s post-2020 climate target isn’t enough to stop 2C warming.)

ANU research associate and pitt&sherry consultant Hugh Saddler on rebounding coal and emissions

Australia’s National Greenhouse Gas Inventory for 2012-13 shows that 29% of Australia’s total emissions came from coal used to generate electricity. Other fuels, mainly gas, used to generate electricity add another 5%, bringing the electricity industry’s share of total national emissions up to 34%.

More than half of these coal emissions come from power stations that are now more than 25 years old. Closing these old power stations and replacing them with wind, solar and possibly some gas generation is technically completely feasible and, on the basis of the best current cost data, would cost less than replacing them with new coal-fired power stations. It is clear, therefore, that reducing the share of coal in Australia’s electricity generation is one of the lowest-cost ways of achieving large emission reductions.

Reducing emissions would be made easier if demand for electricity were reduced, by increasing the efficiency of electricity use. We know that this can be done.

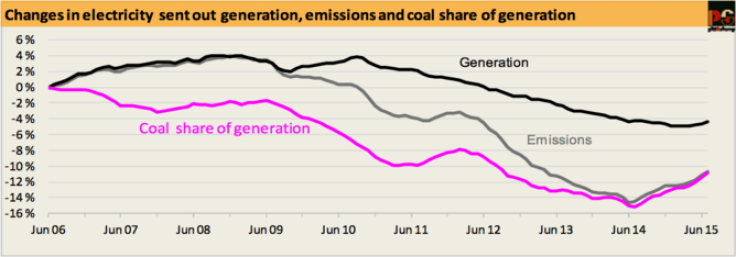

Between 2009 and 2013, the combination of falling demand for electricity and a switch of electricity generation away from coal and towards wind, solar and gas resulted in an emissions reduction of 24 Mt CO2-e, equal to 4% of Australia’s emissions in 2009.

Now, however, demand for electricity and the share of coal in total generation are both increasing. Both will have to turn around if Australia is to achieve the proposed emission reductions.

CQUniversity resource economist and Deputy Dean of Research, School of Business & Law, John Rolfe, on Australia’s coal exports

Factors that reduce the demand for fossil fuels are likely to have some negative impact on the demand for Australian coal, although it remains to be seen how big the issue will be. It is worth noting that Australia exports roughly equivalent amounts of metallurgical coal for steelmaking and thermal coal for power generation; it is only the latter commodity that would be impacted.

In 2013-14, Australia produced 180.8 million tonnes of metallurgical coal and exported it all, and 245 million tonnes of thermal coal, exporting 195 million tonnes, or 80% of production.

If the change in emissions policy only affects Australian domestic demand for coal, then it is possible that some of the 20% of current production that is used for domestic power supply could decline. The extent to which that decline in domestic consumption affects the industry remains uncertain.

Currently, predictions for growth in international demand mean that thermal coal exports from Australia are predicted to increase. The latest Resources and Energy Quarterly from the Australian government pegs the likely increase in thermal coal production to be more than 13% by 2020, with all of the increase going to export markets.

But if Australian power generators reduce their demand for coal further at the same time that international demands grow, then it is likely that growth in production will be slower and there will be some substitution into export markets.

RMIT senior industry fellow and energy-efficiency expert Alan Pears on the risks ahead

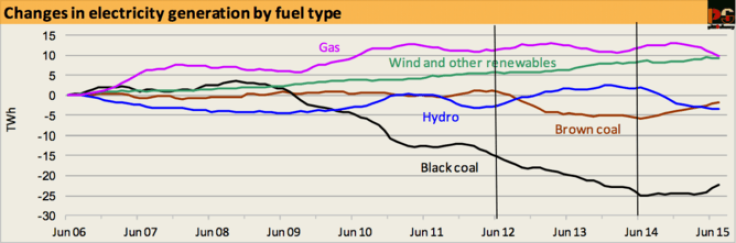

For local demand, the main driver is electricity. Since the removal of carbon pricing, with increases in gas prices and the need for hydro generators to allow their dams to refill (after cashing in on the carbon price by generating as much as possible), coal has recovered some market share. But this is very much a short-term situation.

First, it is very unlikely that any new coal-fired electricity generators will be built: they are risky, take a long time to build at a time of extreme uncertainty, and can’t compete with new renewable generation.

But even to meet its weak proposed [2030] target, the government will have to support further adoption of energy-efficiency measures. It has also shown it is not prepared to take on the rooftop PV industry, because too many votes are at risk. But a weak carbon cap and/or no carbon price does allow existing coal plants to generate more for longer, emitting more carbon dioxide.

The International Energy Agency’s 450 parts per million scenario suggests that global demand for coal would need to drop by around 30% by 2035 to limit warming to 2C. If Australia’s customer countries act consistent with this global target, it is clear that our coal export industry will decline significantly.

On top of that, the economics of improving energy efficiency and renewable energy are continually improving. So recent declines in share value of major global coal companies such as Peabody Energy are not surprising.

University of Western Australia Winthrop Professor of Finance, Accounting and Finance Richard Heaney on replacing existing coal power

Yes, I do think the Australian and international targets could have an impact. Sequestration does not seem to be providing the solution to the carbon problems associated with coal.

If we are to meet the targets our coal usage will need to fall and this leads to a search for alternatives like solar, wind, hot rock, nuclear or less carbon intensive alternative like natural gas or unconventional gas.

Many of Australia’s existing coal fired power plants are nearing the end of their economic lives, so this is a great time to reconsider the sources of energy that we tap into.

As for global demand for Australian coal between now and 2030, it’s difficult to say. If Australia decides to use less coal then this will have an impact on Australian coal production, particularly in areas like the Latrobe Valley for example. It will affect coal exports if the big importing countries like China are able to reduce coal consumption and maintain an adequate growth rate.

The University of Queensland energy economics researcher Lynette Molyneaux on how others nations will shape what happens in Australia

Australia exports around 80% of the coal that it mines. So while a carbon dioxide emission cut by 2035 will undoubtedly affect electricity production from coal, the impact on the industry from reduced electricity production will be comparatively small.

The far bigger exposure to the coal industry will be from global target setting. Australia and Indonesia dominate the export market. Between them they export more than 50% of world’s coal. However, the USA is a far bigger coal producer than Australia. With the USA seeking to limit electricity production from coal, US coal producers will be in the hunt for international buyers, possibly creating significant competition for Australian coal producers. Australia has always sold its coal on its higher quality (higher energy content and lower sulfur). That was possible against Indonesian coal but would not necessarily apply to coal from the USA.

So, if importing countries like India and China do not set targets, coal producers will continue hunting for opportunities there and Australia – with its good-quality coal and proximity to Asia – will be relatively well placed. If, however, India and China themselves set emission reduction targets that reduce their demand for coal generally, then Australia’s coal industry may well be significantly impacted by their target setting.

Australia’s coal industry is at the mercy of global consensus on climate change, not really Australia’s emission targets.

Liz Minchin is Senior Editor & Queensland Editor at The Conversation.

This article was originally published on The Conversation. Read the original article.