Security Token Offerings Expected to Boom Aided by Regulations

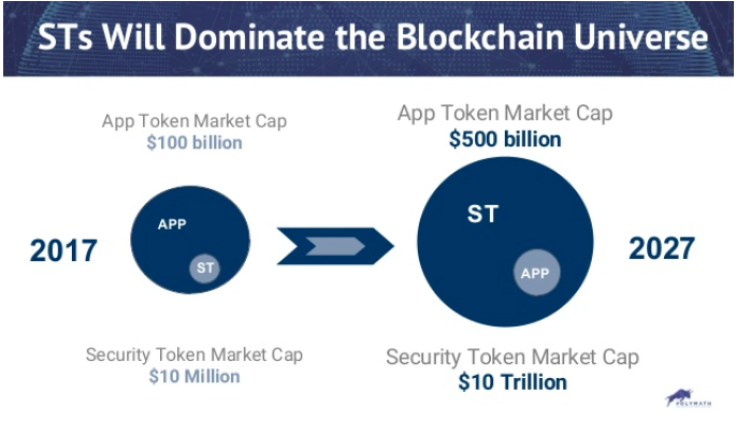

The crypto market can expect a rise in security token offerings (STOs) soon. Various companies recently announced their respective efforts focused on trading crypto tokens that that represent shares or equity.

Secondary trading platform The Elephant just announced that it has taken on Compass Blockchain Solutions as its advisory firm in its STO. Compass is expected to provide legal, marketing, and financial guidance as The Elephant targets offering several high-profile shares from its portfolio by Q4 this year.

US-based crypto exchange Coinbase also received regulatory approval from the Financial Industry Regulatory Authority (FINRA) to acquire several securities firms. The move would allow the company to list security tokens on its exchange.

Established enterprises are also moving into the space. Online retailer Overstock is also working on a security token platform through its subsidiary tZERO which is set to be used by imaging giant Kodak for its KODAKCoin token.

This interest in STOs signal a shift in crypto investments landscape.

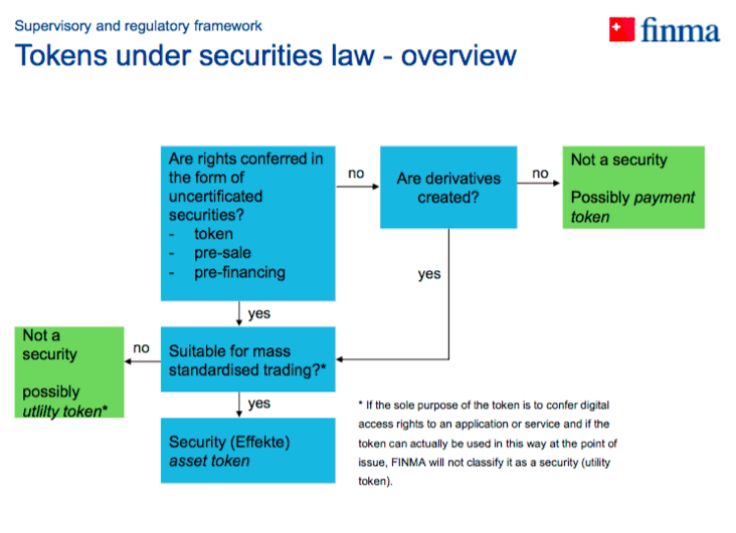

Previously, blockchain ventures operated in a regulatory gray area by taking on investors through initial coin offerings (ICOs). Companies were able to offer crypto tokens that functioned as securities (security tokens), tokens that provide access to platform (utility tokens) or digital currencies (cryptocurrencies).

However, several failed and fraudulent ICOs prompted regulatory bodies to step in. The security breach that affected blockchain-based venture capital fund TheDAO resulted in the theft of what was then worth $50 million of Ether tokens. The US Securities and Exchange Commission (SEC) investigated the incident and eventually ruled that tokens that functioned as securities must be subject to securities laws.

Other regulatory bodies around the globe also issued guidelines concerning their respective territories. Last year, China and South Korea even banned domestic ICOs in an effort to protect their citizens. Today, both countries are working on rules regarding crypto activities that may soon result in easing of restrictions.

European countries are also internally implementing regulations guided by existing EU directives. The EU, as a body, is currently working on a legal framework for its members to use. Concerns regarding financial crimes like money laundering and tax evasion have been voiced due to the pseudonymous nature of blockchain and cryptocurrencies.

These clearer regulations are only helping bolster the security token market. The availability of defined guidelines and rules help ventures and companies work towards compliance. The process may involve significant effort in securing various licensing requirements and regulatory approval but industry stakeholders are also aware of the upsides in becoming players in the space.

Regulations also help recognize and legitimize crypto activities. Concerns regarding the technologies’ use by malicious entities remain, but laws and rules could help provide participants with increased protection.

ICOs continue to generate significant capital generating over $17 billion in funding so far this year which is now almost eight times what was raised in 2017.

STOs have the potential to stoke this growth. Appetite for private equity is growing. Trading of private equity in the secondary market has also grown to a record $58 billion in 2018 - up more than 8 times from $7 billion in 2004.

This confluence of factors can push security tokens towards another boom in the crypto market.