Oil price forecast 2016: Morgan Stanley joins World Bank in predicting price slide, says AUD will move in line

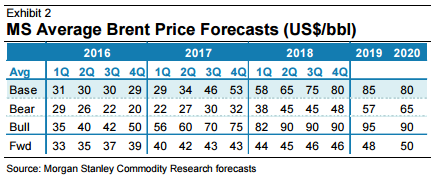

Morgan Stanley has adjusted its oil price forecast for 2016, downgrading its outlook from an average of $49 to $30 per barrel and reversing its earlier prediction that oil prices would recover by Q4.

Citing a supply and demand imbalance, which is expected to persist until 2017, the bank’s Brent price outlook expects the average price per barrel to hit $40 in 2017, before climbing to an average of $70 in 2018.

The bank also expects oil producer currencies, particularly the Norwegian Crown and Canadian dollar, to be negatively impacted by depressed oil prices, reports CNBC. The AUD and NZD, along with exporters of other commodities, should also move in line.

According to Morgan Stanley analysts, the primary challenge is lagging crude oil demand, which must chase up to oil supply levels, especially since production is unlikely to slow over 2016.

“Weaker-than-expected demand, higher-than-expected supply, rising inventories and increased hedging incentives all work to delay rebalancing, and slow the rise in prices immediately thereafter,” analysts said in a report.

“We continue to believe that the oil price beyond 2017 needs to be higher to balance the market. In many cases, this pace of recovery matters as much as the ultimate price.”

Apart from excess supplies from the Organisation of the Petroleum Exporting Countries (OPEC), a Chinese slowdown and depreciating Yuan are also factors fuelling fears of slowing consumption, particularly since China’s surging economy led global oil demand on the incline over the past decade.

The re-emergence of Iranian oil production after sanctions were lifted as part of the Iran nuclear deal, giving it an opportunity to sell on the international market, has also added to speculations of an oil overhang, .

Morgan Stanley’s downbeat forecast of a $30 per barrel average echoes J.P. Morgan’s bearish outlook. Earlier in January, J.P. Morgan dramatically slashed its crude and Brent forecast to $31.50 per barrel.

“The rapid drop in prices since the start of the year arguably reflects the deterioration in fundamentals, but also a growing consensus that focuses on rising stress with regards to Chinese currency policy,” J.P. Morgan analysts said in a note, reports Market Watch.

“However, if these concerns were to become a reality, then [...] there exist further substantial downside to risk markets if China achieves an unprecedented slowdown in industrial production growth.”

The World Bank also slashed its own outlook in January, cutting the price of crude oil for 2016 from an expected $51 a barrel (per its October projections) to just $37.

“Low prices for oil and commodities are likely to be with us for some time,” said John Baffes, Senior Economist and lead author of the World Bank's Commodities Markets Outlook. “While we see some prospect for commodity prices to rise slightly over the next two years, significant downside risks remain.”

Global oil prices had averaged almost $100 a barrel for approximately six years, from 2008 until mid-2014 when concerns about an oversupply began to bubble. These fears were mostly muted as demand maintained pace until the start of 2016, when slowing demand became more evident, particularly in the US and China.

Oil bulls should take heart: Bloomberg

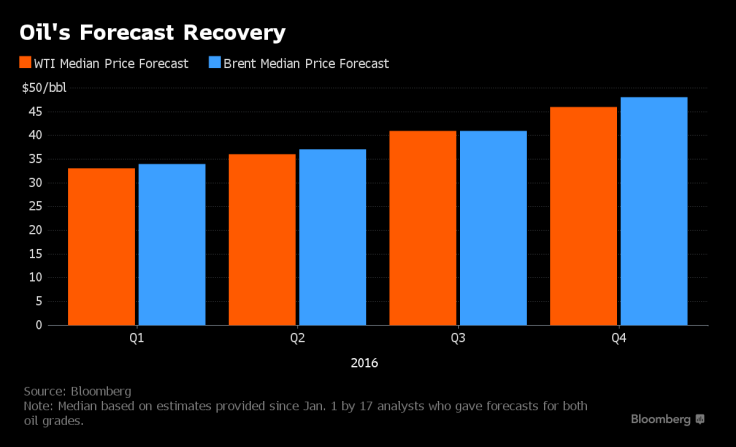

Swimming against the tide of bearish forecasts, however, is Bloomberg, whose analysts are maintaining a positive outlook for oil prices in the second half of the year.

On Thursday, the firm said a median of 17 estimates compiled by analysts projected oil prices would climb more than $15 by the end of the year, as global oversupply shifts to a deficit prompted by a fall in US shale output.

Bloomberg analysts point to US production dropping by 620,000 barrels a day from Q1 to Q4. It also quotes the International Energy Agency forecasts of total non-OPEC supply falling by 600,000 barrels a day this year.

“That may pave the way for a rebound as lower prices have stimulated global demand,” it notes.

RELATED: BHP Billiton to take AU$10.5 billion write down on its US shale assets

Some analysts, including Neil Beveridge at Sanford C. Bernstein & Co. also believe Russia, one of the world’s top producers, may lower its output by as much as 150,000 barrels a day this year. Iraq and the UAE also sees the glut shrinking, even after Iran enters the market.

Morgan Stanley’s about face comes as oil futures rose 10 percent this week boosted by a weak US dollar, before doing a 180 and falling overnight over doubts of a production cut among major producers.

Oil prices fell by 47 percent in 2015, and are expected to decline, on an annual average, by another 27 percent in 2016.