The media and Australia's housing market: Are we in a bubble?

Property is one of the most talked about aspects of Australian life, with complaints about how it’s almost impossible for Gen Y-ers to own their own home, to debates over whether there is a housing bubble and whether that bubble may burst soon being some of the most common real estate topics.

With Australia’s 9.6 million residential properties worth a whooping $5.9 trillion at the end of the 2015 September quarter -- three times Australia’s GDP -- and the construction industry being Australia’s third largest employer -- over 330,000 people are employed in residential building construction -- housing is also an industry that has very real economic effects.

According to a report by the Australian Bureau of Statistics released at the end of last year, homeowners across the country have witnessed the ‘booms and busts’ associated with growth cycles over the last ten years, with prices peaking in December 2009 before settling for the next two years or so. The industry then witnessed steady growth over the past three years, and in the last 12 months, the ABS indicates that there has been a slight slowdown, with the September quarter of 2015 witnessing a slower rate of increase.

But is this a housing bubble, or a boom? And is the bubble bursting or is it just another cooling of prices?

A housing bubble refers to a period of above average growth in property prices, which is fuelled by high property demand and speculation in the market.

This is succeeded by a drop in prices to where they were before the bubble started forming or even lower, when supply outstrips demand. This scenario is also known the bursting of the bubble -- when investors start realising they want to ‘get out’ of the market at the same time or when bad loans begin defaulting, as was the case with the US subprime mortgage crisis, which triggered the 2008 GFC.

A bubble is distinguished from a boom predominantly by its participants, namely speculators who enter the market to make a quick buck by short-term buying and selling, which drives demand.

The ABS report indicates that house prices in Australia have risen in the current growth cycle due to historic lows in interest rates, which stimulated demand in the property market and home loans. The ABS separates these home loans into two categories, that of investor loans and owner-occupier loans. However, investors are the group driving the rapid rise of home loans.

Daniel Lowe, a Sales & Property Management Assistant at Professionals Outer Western Sydney, confirms that the large levels of growth in property values experienced by the Sydney property market over the last two years have been from “investor driven demand,” which has had the effect of “increasing the supply of rental properties available”.

These investors are catering towards younger families and people moving out of home for the first time, who see renting as a more “viable option” to buying, Lowe adds.

If some media narratives are to be believed, this investor-driven demand is causing a housing bubble to form; a bubble that will inevitably burst due to an over-saturation of the housing market, where housing prices are “too high” and “overvalued”. A report by news.com.au from nearly a year ago details claims from Lindsay David, founder of LF Economics, saying that the housing market bubble will burst by 2017, potentially destabilising the economy as happened to America after the GFC.

More recently, ‘60 Minutes Australia’ ran a segment with US economist Jonathan Tepper, who had posed as a potential buyer with hedge fund manager John Hempton while touring properties in Sydney’s west.

The duo found that there was a lot of supply and “prices that bore no resemblance to construction cost and income of people” living around the area.

“It’s happened in Ireland and it’s happened in Spain,” Tepper said. “But this is beyond anything.

“We are in unchartered territory.”

Tepper's prediction? Australia’s real estate market bubble will soon burst and wipe out half of the country’s property value.

Journalism lecturer at the University of Notre Dame and a news producer at ABC, Albert Lecoanet, tells International Business Times Australia that these media reports “influence the way buyers and sellers behave,” meaning the common stereotype of markets being too saturated could eventually lead to a “slowing down of the market”.

Simeon Predic, a Sydney-sider who is currently renting, agrees that the media is key when it comes to informing potential home buyers. This influence extends not just to predicting general market trends, but also about which areas home buyers believe are going to perform well, since “the media reports on all the crime, the violence and leads with this area or that area”.

But Lecoanet joins Lowe in noting that the media does not have the final say in what people in the housing market decide to do.

Lecoanet is also quick to point out that reports about a housing bubble are predominantly looking at the Sydney and Melbourne markets.

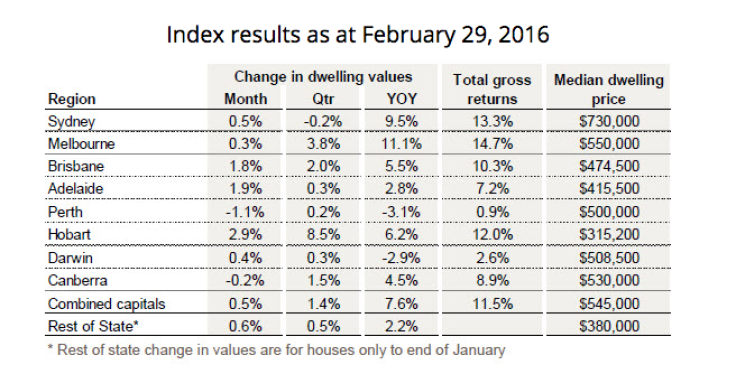

In fact, a recent report by news.com.au which uses data from the CoreLogic Hedonic Index indicates that several capital cities are beginning to show signs of growth in the housing market, with prices being pushed up as newer properties are being put on the market. Hobart led the way in February with a 2.9 percent increase, followed by Adelaide with a 1.9 percent increase and Brisbane with a 1.8 percent incrase in prices.

Some media reports are also sceptical about forecasts of a housing market crash. Smart Company claims that there will be no sudden pricing drop, except in some areas such as mining towns as the conditions required for a market crash are not there. Reports from Domain and The Australian also agree that for a crash to occur there would have to be a combination of these conditions, which include a major recession, increased unemployment rates and excessively high interest rates.

The Australian article refers to information from the RBA, which modelled the impact of a six percent jump in unemployment and a 25 percent fall in house prices, and found that there would be limited expected losses from loans and a high level of financial resilience from homeowners. This is due to household debt being held by high income Australians who can afford to bear it.

“An interesting moment in the market will be when the economy and salaries actually slow down for real and mortgage repayments are not met on a massive scale,” Lecoanet concludes.