Fintech is disrupting the way we see financial institutions

Traditional banking might soon be a thing of the past, as financial technology startups are already stepping up to provide solutions that better fit the needs of institutions and mobile individuals.

This brave statement was given by former Credit Suisse banker John Hucker, who is also the president of the Swiss Finance + Technology Association. The shift, he said, was brought about by the fact that the fintech industry is no longer focusing on finding breakthrough ideas but on the next level — customer and investor needs.

The rapidly expanding cohort of fintech start-ups can better meet the demands of the established banking system, according to a vision from the President of the Swiss Finance + Technology Association. He said the answer was to shift focus from a tsunami of fintech ideas to the needs of companies and investors.

“In a sense, we want to do less structured farming and foster a more fertile, jungle-like environment capable of fostering the commercialisation of new innovations,” he said.

This message was reiterated during the two-day Fintech+ Conference held in Zurich wherein Swiss financial technology start-ups were encouraged to dream big and try to provide services that could challenge more established financial firms in providing new products and services for the modern client.

This is done by tackling themes and possible avenues like how artificial intelligence can be used for wealth management, handling insurance and supporting sustainable sectors. Hucker said that this was important because he didn’t believe that traditional financial institutions like banks can live up to the demands of the modern customer.

“Today, the Swiss financial centre operates on a well-established business model but it is in decline and increasingly vulnerable to disruption. New solutions are needed and they are likely to come from new sources in the fintech ecosystem.”

The event also gave fintech participants the chance to meet with possible accelerators that could provide them the opportunity to be connected to venture capitalists that could boost their business.

Avenues for fintech to thrive

According to Forbes, there are three avenues where fintech companies are expected to grow exponentially in the coming years. First is the real estate tech sector, which was reported that in the past 12 to 18 months has shown impressive growth. During the Forbes' 30 Under 30 Summit in Boston, it was revealed that real estate groups like Brookfield are investing venture funds on fintech groups.

Then there’s Insuretech, another growing category. This basically means that fintech startups can upgrade technology stacks like payment technology and infrastructure for tech set-up.

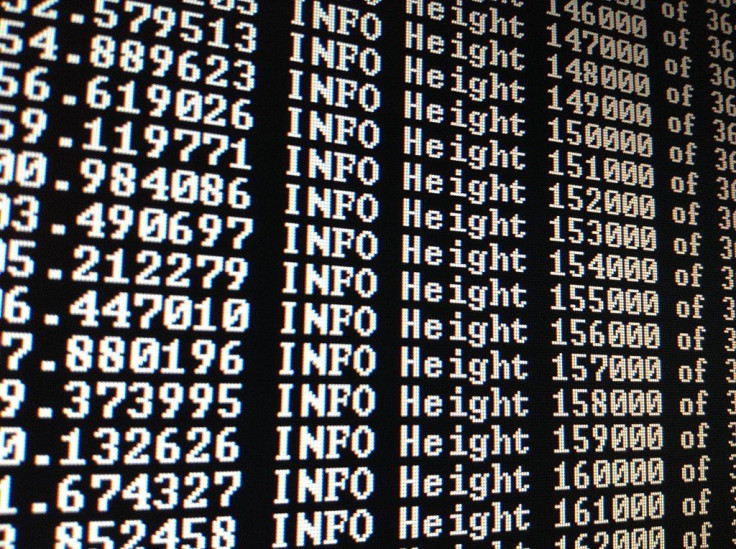

This is where blockchain technology could come in, which could play a big role in transforming a company’s tech system. Clic Technology (OTCMKTS:CLCI) is one company that addresses this. This blockchain-based solution was developed for a number of financial transactions including e-commerce.

Clic Technology is composed of a team of crypto and financial professionals that build innovative and proprietary blockchain solutions that enable a convenient and safe transaction for businesses that are conducting business across the globe.

The company has built a set of tools that convert cryptocurrencies to dollars without fuzz so enterprises can take advantage of US$200 billion (AU$283 billion) in crypto funds. Clic Technology aims to normalise cryptocurrency payments, crypto wallet, crypto mining, and other cryptocurrency endeavours.

What’s unique about the company is that its products are developed from the ground up by exceptional Clic Technology developers. The group has a PCI-DSS Level 1 certification that guarantees customers’ data safety and the highest level of security for payments.

Clic is one of the leaders in the blockchain industry as the company is among the first publicly traded groups that bank on blockchain products to address the future of global commerce. Its proprietary technology allows buyers with the convenience to spend their cryptocurrencies without a problem. In return, merchants also won’t have a problem turning their cryptocurrency into cool cash. This positions Clic to be the first fintech player to present this kind of financial solution to the market.

Through Clic, a blockchain solution means that merchants can accept bitcoins and altcoins as if they were dollars or yens. Users can then enjoy the ease of making payments using cryptocurrencies without having to go through a bank and pay for exorbitant transaction fees.

And lastly, another avenue for fintech solutions are the paper-dominated industries, which, according to Forbes, can uncover a lot of opportunities.

This is because as most companies still operate using paper bills or cheque, elevating their financial transactions with fintech solutions can offer many conveniences.

IBTimes Australia does not endorse any product or practice mentioned here. The article is based on press releases sent for consideration.