Canada's Diavik Diamond Mine Receives $350M Boost From Anglo-Australian Miner Rio Tinto

Anglo-Australian mining giant Rio Tinto has set aside $350 million to expand the Diavik diamond mine in Canada, one of the country's oldest diamond mines.

The company said Thursday it will develop the A21 kimberlite pipe of the project during a four-year expansion plan. Rio Tinto controls a 60 percent stake in the Diavik joint venture, located 300 kilometres northeast of Yellowknife. The construction of a dike around the ore body, located under a lake, is also part of the expansion plan. Dominion Diamond Corporation controls the remaining 40 percent of the project.

The A21 diamond production, according to Rio Tinto, has been planned for late 2018. The A21 production will provide an important source of incremental supply for Diavik, ensuring the continuation of existing production levels, it said in a statement. The company said it will utilize the same innovative design and engineering technologies used to construct the Diavik mine's two other dikes that enabled mining of three existing pipes. The additional A21 kimberlite pipe is located just south of Diavik's existing mining operations.

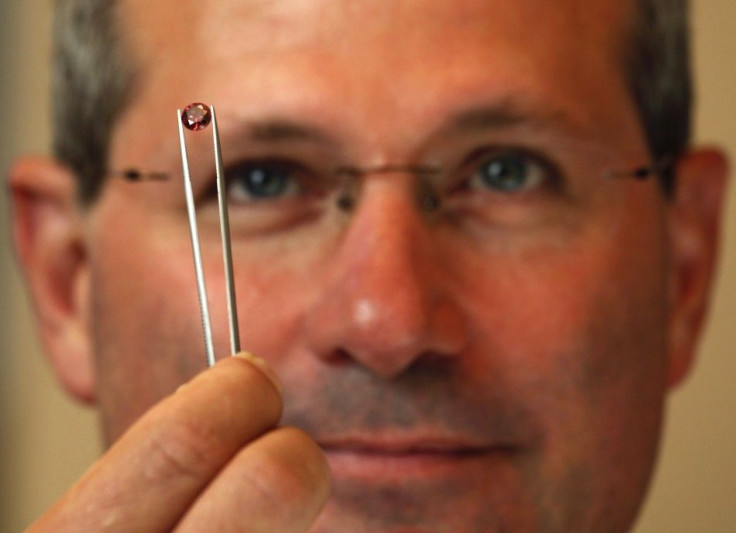

The Diavik Diamond Mine started production in 2003. It became a fully underground mining operation in 2012. The mine produces predominantly gem-quality diamonds destined for high end jewellery in all major consumer markets around the world. However, put it up for sale in the same year because its contribution to the company's earnings was too small at only less than 2 percent. But Rio Tinto failed to find a suitable buyer, thus maintained ownership of the project.

"Our decision to invest in the Diavik A21 project reflects our strong confidence in the diamond sector and in our ability to compete in the industry," Alan Davies, Rio Tinto Diamonds & Minerals chief executive officer, said. Apart from Diavik, Rio Tinto has two other diamond mines. It has a 78 percent interest in the Murowa diamond mine in Zimbabwe, while it is the sole owner of the Argyle mine in Australia.

Diavik is close to the Ekati mine that Dominion Diamond Corporation bought in 2013 from BHP Billiton. The Yellowknife area has attracted the interest of other mineral explorers.