Blockchain Expert Oliver Isaacs Explains The Rise Of Blockchain And Cryptocurrency

Cryptocurrencies— the best known of which is Bitcoin — are a relatively new class of financial instruments which are a kind of a financial equivalent of peer-to-peer file sharing networks. Much like Napster or BitTorrent. The idea was to replace physical gold, which, arguably, has relatively little intrinsic value as an alternative to fiat currencies.Thus, implement the libertarian agenda of people controlling the means of production (computing hardware) and the means of payment, and depriving government of their monetary authority.

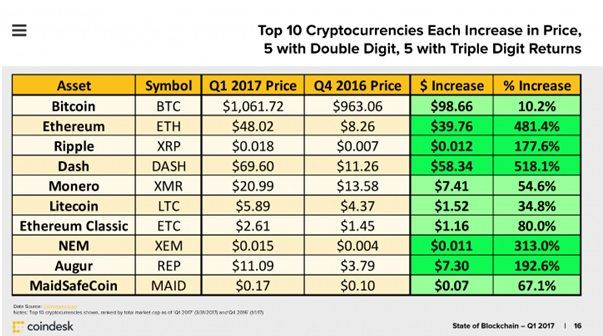

The past year has been very kind to cryptocurrency investors, despite their ultra-volatile behaviour. A look at the historical data over the past year shows return rates between 1000% and 10000% percent for the top cryptocurrencies over the past year. Bitcoin, Ethereum, Ripple, Dash and Neo are by far some of the best performers as of the end of 2017.

Someone more than familiar with these statistics is Oliver Isaacs — one of the world’s foremost authorities on cryptocurrency and blockchain investing. A prodigy, being only in his early 20s, Isaacs is a major figure in the tech world. He is the founder of Amirite, running a large network of pages on Facebook and Instagram reaching 15 million users each month, and influencing and advising those in the block chain and Cryptocurrency space leveraging his following of over 1 million followers across his social channels. Isaacs has given talks around on the globe at major tech conferences such as Techcrunch Disrupt and Web Summit on topics ranging from investing, blockchain technology and cryptocurrencies.

Isaacs has also been featured in the Instagram and Snapchat Stories of high profile entrepreneurs giving business and investing advice. These include Tony Robbins, Mark Cuban, and Tim Ferris. He maintains close relationships with his solid investor base such as those he has worked closely with and advised—including Pantera Digital Asset Fund, Arrington XRP Capital, and BlockTower Capital who manage a total combined capital fund of over $500 million.

Isaacs founded Amirite.com, an opinion-based social network that allows people to express their ideas and opinions about current affairs.With this start in the tech world, he soon rose to be a prominent figure, working as an adviser to Fortune 500 Companies and tech investors.

Isaacs successfully invested and purchased many holdings of digital currencies very early on. He has also helped coordinate the strategy for a number of well-known ICOs too (Initial Coin Offerings) and has participated in the ICOs of Ethereum, Augur, and multiple other well known blockchain companies with returns of some of these exceeding 10,000%.

In a recent interview with Bloomberg, Isaacs laid out well why prices have been rising. He emphasised that cryptocurrencies are subject to supply and demand, thus their exchange rates are determined by the market. The recent upward pressure in BTC and altcoin values since the end of summer 2017 resulted from a wave of speculators out to chase profits.

In addition to the notable uptick in drift, volatility over the recent time period has remained essentially unchanged. The New York Stock Exchange is asking regulators for permission to list five new funds linked to bitcoin futures on one of its markets. Rival exchanges CBOE Global Markets and CME Group both launched bitcoin futures contracts in December, which allow investors to bet on the future price of bitcoin.

Cryptocurrency specific hedge funds have raised $1.2 billion as of May last year, and the influx of capital shows little sign of slowing. Cryptocurrencies are a finite resource; in the case of BTC, only 21 million coins will ever be issued. Thus, the influx of new capital has created demand pressure that far outpaces supply.

Cryptocurrencies have slowly become accepted by a wider mainstream awareness. Whether this is due to media hype or the eternal pursuit of profits is arguable. Regardless, many well-known businesses see an opportunity to take advantage of the multitude of cryptocurrencies and have begun accepting digital currencies as payment. The Amazons of the world are not the only companies jumping on the bandwagon; smaller foreign brick-and-mortar retailers are planning to launch their own cryptocurrency platforms for use by their customers.

The fundamental technology that gives digital currencies their power, the blockchain, is also being adapted for use in other areas that are unrelated to finance or trading. Blockchain is one of the most innovative technologies around in the tech world and has the potential to revolutionize numerous industries and shape our future, whether it be healthcare, defense, government, law or energy. More people need to start paying attention to entrepreneurs, investors and influencers at the forefront of the industry.