Australia's top tech startups neglected by National Innovation and Science Agenda in favour of increased scientific research, critics say

The Turnbull Government has been vocal about its support for Australian startups, but its innovation commitment came under fire on Monday when Pete Cooper, founder of StartSoc, questioned Assistant Minister for Innovation Wyatt Roy on the ABC’s QandA program about the lack of funding backing start-ups..

Cooper asked why the government decided to allocate funding for research but not for innovative startups as part of its $1.1 billion National Innovation and Science Agenda.

The government is set to invest $459 million in scientific research over the next four years, with an additional $127 million in grants for university research.

“University research is important but most tech startups are doing without it—why aren’t we supporting them in the innovation statement?” Cooper asked. “Why are we doing ‘slow-lane’ innovation?”

Roy was quick to defend the government’s agenda, which he said instead encourages startups through policy.

Noting that Australia could not replicate the startup environments of Silicon Valley, Tel Aviv and Singapore, Roy called for creating “a uniquely Australian innovation ecosystem” by making Australia an attractive base to launch startups from.

“Our lifestyle is acting as a magnet for attracting the best and brightest,” he added.

Currently, 38 percent of Australian startup staff are born overseas, with the most popular countries of birth being the UK, India, New Zealand and the US. Sydney, a popular tourist drawcard, is home to almost half of all Australian startups.

Roy said that instead of having the government fund startups, it was better to encourage cultural changes such as embracing risk, accepting failure and celebrating success, as well as increasing collaboration between startups and industry. This would then attract more private capital, he said.

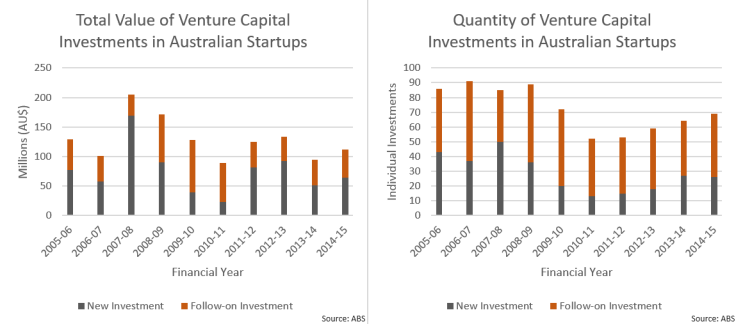

Over the past decade, private investment in Australian startups has not increased.

Cooper was quick to reply: “the money doesn’t match the words, mate.”

“Uber’s doing four times what you put over four years—in four months!”

Roy pointed to Israel as an example of a flourishing startup ecosystem with little government investment.

The country has the highest number of startups and entrepreneurs per capita in the world.

“[Israeli] government investment is actually declining but private sector investment is going through the roof because they’ve pulled the right policy levers when it comes to taxation and venture capital to ensure that private sector investment is happening,” said Roy.

Under the Australian government’s new scheme, early investors in innovative startups will receive a 20 percent tax offset as well as an exemption from capital gains tax.

Under the agenda, startups will also be able to use crowd-sourced equity funding, easily employ foreign staff through a simplified visa process, and have access to anonymous, non-sensitive public data.

Roy concluded that funding university research doesn’t necessarily detract from the government’s support to startups.

Opposition spokesperson for digital innovation and startups Ed Husic agreed with the need for greater encouragement for private investment in Australian startups, but conceded that Australia will “never be able to match the volume of investment in larger markets.”

“We can’t just sit on our hands and think ‘it’s too hard for us’,” he said. “We’ve got to find ways to move capital into this space to support good ideas, we’ve got to make sure we’ve got the talent there in order to capitalise on that.”

Meanwhile, Sydney-based nanotechnology researcher, Associate Professor Michael Biercuk, commented that government funding for research was actually necessary for startups in the long-term.

“Whenever we talk about Atlassian or Seek, or Google, or Facebook, or Uber, or AirBnB, 90 percent of the unicorn companies are software companies, but all of those software companies are working with hardware that was developed not over months or years, but over decades, and all of that investment came, by and large, from the public sector,” he said.

“If all we do is we focus our innovation policy on what venture capital does very well already, then what will happen is that in the 20-50 year timescale, we’ll completely run out of steam.”

This comes as the 2015 Startup Muster survey found that 34 percent of Australian startups sought funding or grants from the government, while 25 percent called for the government to incentivise private investment.

The survey also found that 60 percent of Australian startups were funded by Australian private capital whereas only 26.7 percent had received public grants.

Fellow panel-member, venture capitalist and innovation consultant Sandy Plunkett stressed the need to become competitive in a global startup environment.

“There’s no doubt that we are trying to catch up from a place where we’ve been very far behind for decades,” she said.

“We have to learn how to invest and make bold bets on a future that is rapidly globalising and technology driven.”

Meanwhile, during the QandA broadcast, viewers raised more issues about the 'ideas boom' and innovation discussion.

How engineering centric is the Silicon Valley startup model? Marketing and financial engineering, maybe? #qanda

— Paul Wallbank (@paulwallbank) March 28, 2016

Aus was a startup nation before the politicians stopped investing and the tech was sold to others! Thinking about wind energy... #qanda

— Emily Rochette (@EduScholar007) March 28, 2016

#qanda every conversation assumes innovation and startup culture is all about "young people".

— Sha Menz (@ShahMenz) March 28, 2016

Guess what? 50 & 60 year olds have ideas too!

Innovation is education and culture based. That's why nobody knows thee difference between a startup and a business, there isn't one #qanda

— Stuart Fazakerley (@stuartfaz) March 28, 2016

With startup culture, a big concern is our general indifference to diversity - THE essential ingredient for constant #innovation. #qanda

— Julian B (@MrJulianB) March 28, 2016