Australia To Join China-Based Investment Bank

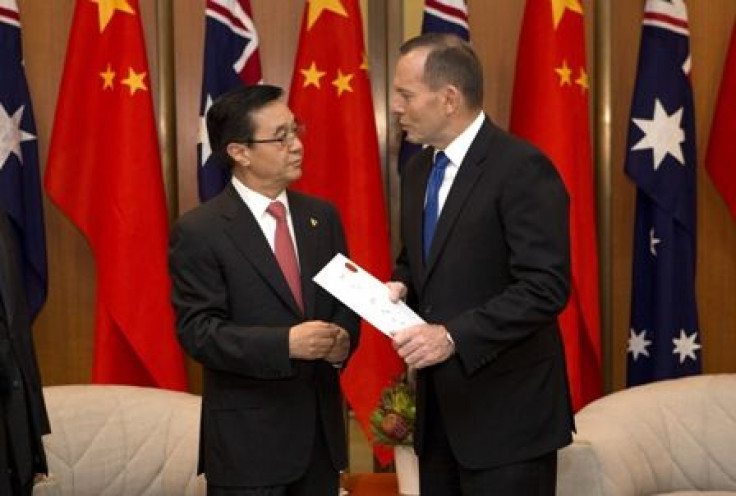

On Wednesday night, Treasurer Joe Hockey announced that Australia is all set to become one of the founding members of the Asian Infrastructure Investment Bank (AIIB). The decision to join the China based bank comes after major discussions between the Australian government, China and other strategic partners.

According to The Guardian, Mr. Hockey expressed his confidence over the tie up and said that joining the AU$130 billion bank would open up an avenue with massive new opportunities for the Country. To formally sign up the investment deal in the presence of 56 other countries that supported it, he would travel to Beijing on Monday.

The Guardian further reported that the World Bank, the Asian Development Bank and other multilateral banks would join the new bank in its venture to bring about an estimated AU$10.37 trillion infrastructural development in Asia over the next 10 years making it the sixth largest shareholder. ABC reported that the bank would run on both private and public funding and would “start with an authorised capital base of AU$1.30 billion.” Meanwhile, it is believed that this venture would garner both political and business support from all over the world.

The decision could be called unanimous because the federal opposition has expressed its willingness to join the bank and appreciated the government in this endeavour. According to Skynews, CPA Australia boss Alex Malley confirmed that this strategic partnership was not an overnight decision but had been in the making for some time. "We are absolutely satisfied that the governance arrangements now in place will ensure there is appropriate transparency and accountability in the bank," Mr. Hockey said while addressing the nature and the structure of the bank.

Countries like New Zealand, France, Germany, Italy and the U.K. are also in similar partnership with China investing in their socialist market economy. Australian Chamber of Commerce and Industry head Kate Carnell said “better infrastructure, including ports, airports, road, rail and power supplies, helped facilitate trade.” Tony Cripps, CEO of HSBC Australia proposed that the country would strive to bring about growth with its important trading partners and simultaneously look after Australian businesses.

Contact the writer on priya.shayani@gmail.com.