Is Amazon stock about to pop or drop?

Amazon (NASDAQ: AMZN) was trading at $1648.82 per share on March 7, 2019. The recent performance of this top-tier stock has been shaken by several developments in recent weeks.

Amazon’s stock indicates several important trends. For starters, the 50-day moving average – a short-term indicator of the stock's performance - is less than the current price ($1,619.74 versus $1,648.82) indicating a short-term uptrend is on the cards. However, the long-term trend for Amazon is concerning. The 200-day moving average for Amazon.com is $1727.45, markedly higher than the prevailing price. With these elements in mind, it's important to take a closer look at the performance of Amazon.com.

The earnings figures for this top-tier stock are positive. Consider the actual earnings versus estimated earnings per share (EPS) figures:

- Q1 2018 estimate of EPS – $1.26 with actual earnings of $3.27. (Earnings beat)

- Q2 2018 estimate of EPS – $2.54 with actual earnings of $5.07. (Earnings beat)

- Q3 2018 estimate of EPS – $3.14 with actual earnings of $5.75. (Earnings beat)

- Q4 2018 estimate of EPS – $5.68 with actual earnings of $6.04. (Earnings beat)

- Q1 2019 estimate of EPS – $4.73 with actual earnings yet to be announced between April 24 – April 29, 2019

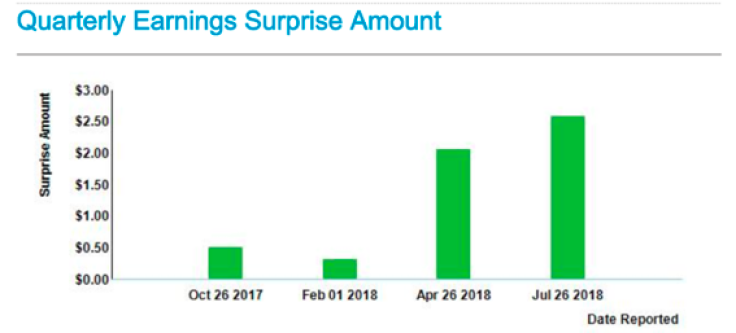

The earnings surprise data on Amazon is an important barometer of the stock's viability as an investment option. The company has consistently outperformed on expectations, with an 8.83% earnings surprise on the NASDAQ in December 2018. In September 2018, the earnings surprise amounted to 74.77% according to the NASDAQ figures, and the fiscal quarter ending in June 2018 generated a 103.61% earnings surprise. These tend to have a positive impact on trader and investor sentiment and it naturally lends to enhanced growth prospects for the stock.

Amazon.com stock has a market capitalization of $809.996 billion (March 7, 2019) and is one of the mega-stocks on the NASDAQ. It ranks among the most valuable companies by stock-market capitalization in the US, and the world. Other mega stocks include Microsoft Corporation (MSFT), Apple Inc (AAPL), Alphabet Incorporated (GOOG), Berkshire Hathaway Inc (BRK-B), and Facebook Inc (FB).

The 1-year target estimate price for Amazon (AMZN) is $2,079.58, an uptick of approximately $400 on the current price. This indicates a degree of optimism from investors and traders. Another useful indicator of Amazon.com’s performance is the 52-week trading range of the stock. Amazon’s low of $1,307 was the result of a multi-month downswing beginning in August 2018 and ending in late December 2018. The stock enjoyed a lukewarm recovery in the months that followed, with a degree of stabilization taking place in Q1 2019.

What are analysts saying about Amazon?

Amazon is currently being watched by scores of analysts in the trading arena. The stock has consistently generated a favorable recommendation rating over the past quarter. On a ratings scale of 1 - 5, where 1 represents a strong buy and 5 represents a sell, Amazon (NASDAQ: AMZN) is currently at 1.8. This places it firmly between a buy and a strong buy. The company's financials are certainly impressive to boot. For example, in 2017 Amazon generated revenue of $177.87 billion and earnings of $3.03 billion. Fast forward to 2018, Amazon generated revenue of $232.89 billion and earnings of $10.07 billion for a 3-fold increase in earnings capacity.

As far as upgrades and downgrades go, several ratings companies have put their proverbial pen in the plate and gone long on Amazon stock. The latest upgrade to buy was made by Pivotal Research on February 1, 2019. Prior to that, Telsey Advisory Group, Evercore ISI Group, Moffett Nathanson and Raymond James were among many companies upgrading their outlook for Amazon. According to stats, Amazon employs 647,500 full-time workers and is a specialty retail industry with a focus on consumer cyclicals. Investor sentiment is heavily influenced by strategic decisions made by the company, in addition to the opinions of leading analysts.

In March 2019, Amazon announced that it would be closing all pop-up stores across the US. Amazon is shuttering 87 of its pop-up stores as it reassesses its retail strategies. The pop-up stores are physical stores across the United States. The decision needn't be perceived as a negative for Amazon. This company's strength lies in its virtual presence, not expensive, antiquated, and inefficient land-based models with limited profit potential.

Amazon to Shift Focus to the Customer Experience

The company will now be focusing on its bookstore and customer choices which have always been its core strengths. Amazon is not decreasing its presence in physical retail; on the contrary, it is in the process of expanding its presence across multiple sectors. The purchase of Whole Foods (in 2017) is a case in point. Rather than focusing on the pop-up kiosk program, Amazon will be developing its Amazon 4-star system to expand its selection and enhance the customer journey.

Further investigation of the decision by Amazon to close 87 pop-up kiosks indicates that Amazon is not afraid to dip its feet into new waters. The company is an innovation leader and proponents of Amazon are supportive of these initiatives. The objective is to improve the customer experience, and the 4-star stores situated in Berkeley California, Denver Colorado, New York City, New York are great examples of innovation in action.

The stores sell books, consumer electronics, kitchen products and a hodgepodge of other items. Of equal importance is Amazon's decision to open several dozen grocery stores across the continental United States. These are separate from Amazon's Whole Foods. There are now 10 Amazon Go stores in cities like San Francisco, Seattle, and Chicago where digital systems finalize purchases through smartphone apps and the use of multiple cameras.

For many reasons, investors are eager to cash in on Amazon’s growing popularity. The stock is boosted by Amazon’s diversity: it has a hand in multiple industries and its subscriptions-based model is best suited to long-term growth prospects. Investors prefer high margin products and this is precisely what Amazon offers. The company is also considering its own healthcare system and if it gets that recipe right, there is no end to the positive externalities that come with it.